Quarterly Financial Report - For the quarter ended September 30, 2021

Statement outlining results, risks and significant changes in operations, personnel and programs

Introduction

This quarterly report should be read in conjunction with the Main Estimates. It has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by Treasury Board. This quarterly report has not been subject to an external audit or review.

The role of the Courts Administration Service (CAS) is to provide effective and efficient administrative, judicial and registry services to the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. Further details on CAS’ programs can be found in the 2021-22 Main Estimates.

Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes CAS’ spending authorities granted by Parliament and those used by the organization consistent with the 2021-22 Main Estimates. Please note that authorities approved as of September 30, 2020 represent only 9/12 of 2020-21 Main Estimates. This quarterly report has been prepared using a prescribed financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before monies can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or legislation in the form of statutory spending authority for specific purposes.

CAS uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

Highlights of fiscal quarter and fiscal year to date (YTD) results

Significant Changes to Authorities available for use for the fiscal year

As illustrated in the Statement of Authorities and the Departmental Budgetary Expenditures by Standard Object tables at the end of this report, yearly authorities available for use as at September 30, 2021 increased by $22,847 thousand (31%) compared to the same quarter in 2020-21, from $73,690 thousand to $96,537 thousand. The increase is due to the approval of the full 2021-22 Main Estimates in September 2021 compared to last year’s approval obtained in December 2020. Consequently, as of September 30, 2020 CAS had only received 9/12 of its 2020-21 Main Estimates.

As a result of the Government expenditure management cycle and certain conditions imposed by Central Agencies, there are often significant fluctuations by quarter between authorities received and the timing of expenditures realized.

Significant Changes to Expenditures

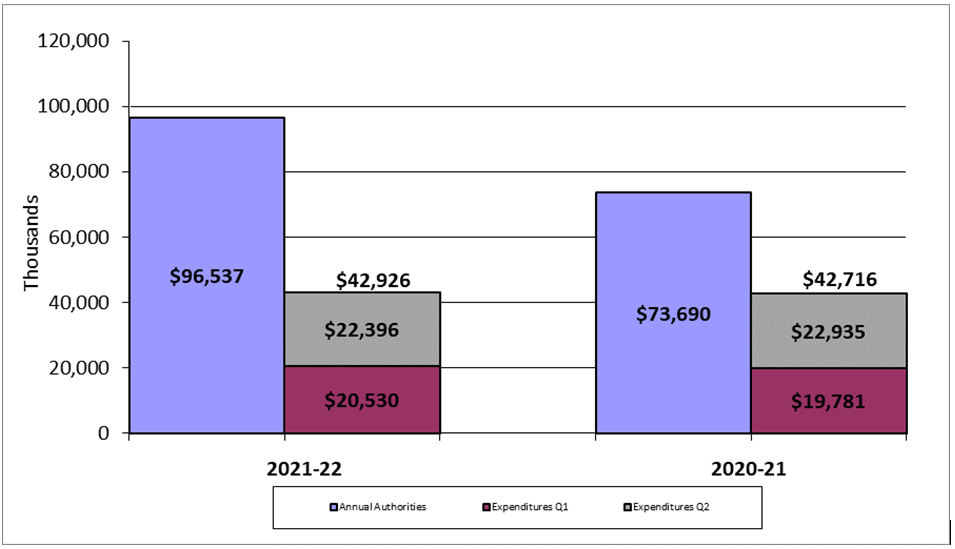

Figure 1 presents current and prior fiscal year expenditures compared to annual authorities at the end of the first quarter. These results are discussed in the section below.

Description of the image

At the end of the second quarter of 2021-22, authorities totalled $96,537 thousand compared to $73,690 thousand at the end of the same quarter of 2020-21.

At the end of the second quarter of 2021-22, expenditures totalled $42,926 thousand compared to $42,716 thousand at the end of the same quarter of 2020-21.

Second-quarter Expenditures

As illustrated in Figure 1, second-quarter expenditures decreased by $539 thousand (-2%) compared to the same period of the previous fiscal year, from $22,935 thousand to $22,396 thousand. As a result, 23% of the yearly authorities available for use were expended during the second quarter of 2021 22. If CAS had received full supply at the same point in time in 2020-21, the percentage of yearly authorities spent would be comparable.

Significant variances1 in expenditures are explained as follows:

Personnel

The year-to-date expenditures related to personnel have increased by $3,524 thousand (11%) compared to the same period of the previous fiscal year, from $30,664 thousand to $34,188 thousand. The increases in personnel expenditures were principally driven by the signature of the new collective agreements, which resulted in retroactive pay as well as increases in salaries.

Information

The year-to-date expenditures related to information increased by $80 thousand (37%) compared to the same period of the previous fiscal year, from $215 thousand to $295 thousand. This increase was mainly driven by an increase in electronic subscriptions and yearly cost increase of publications for the judicial library.

Professional and special services

The year-to-date expenditures related to professional and special services increased by $433 thousand (12%) compared to the same period of the previous fiscal year, from $3,536 thousand to $3,969 thousand. This increase was mainly due to the increase of protection services in the second quarter of 2021 22. In line with the COVID-19 pandemic restrictions, protection services in 2020 21 significantly decreased due to the reduction of in-person court operations.

Rentals

The year-to-date expenditures related to rentals decreased by $695 thousand (-37%) compared to the same period of the previous fiscal year, from $1,861 thousand to $1,166 thousand. This decrease was mainly due to the timing of office buildings rental invoices between quarters.

Repair and maintenance

The year-to-date expenditures related to repair and maintenance increased by $109 thousand (130%) compared to the same period of the previous fiscal year, from $84 thousand to $193 thousand. The increase in expenditures was mainly attributable to an increase in repairs of office buildings.

Utilities, materials and supplies

The year-to-date expenditures related to utilities, materials and supplies decreased by $294 thousand (-15%) compared to the same period of the previous fiscal year, from $2,022 thousand to $1,728 thousand. The COVID-19 pandemic required the implementation of measures for the safe return to in-person court operations, such as personal protection equipment and acrylic shields. The amounts spent on these measures in 2021 22 decreased compared to 2020 21.

Acquisition of land, building and works

The year-to-date expenditures related to acquisition of land building and works decreased by $2,703 thousand (-94%) compared to the same period of the previous fiscal year, from $2,889 thousand to $186 thousand. This decrease was mainly driven by the timing of leasehold improvements for reconfiguration of office buildings, including the completion of large projects early in 2020-21.

Acquisition of machinery and equipment

The year-to-date expenditures related to acquisition of machinery and equipment decreased by $279 thousand (-40%) compared to the same period of the previous fiscal year, from $705 thousand to $426 thousand. In the previous fiscal year, due to the COVID-19 pandemic, there were significant acquisitions of informatics equipment, office equipment and furniture, resulting in a comparative decrease in these expenditures in 2021 22.

Remaining expenditures (transportation and communications, and other subsidies and payments)

Immaterial variances compared to the same period of the previous fiscal year are the results of the COVID-19 pandemic and the timing of the delivery of goods and services.

1 Significant variances are defined as variances by standard object that are greater than $250 thousand or 25%.

Risks and Uncertainties

Funding

CAS received funding in 2020-21 to continue the Definition Phase of the Courts and Registry Management System (CRMS) Project, for the delivery of justice, and for the expenditures incurred due to the COVID-19 pandemic. Following consultations with the industry and refinement of the project scope and approach, new risks were identified regarding the feasibility to continue as planned with the initial scope and approach of the project.

In Budget 2021, CAS received one-time funding for COVID-19 related costs in 2021-22 and ongoing funding for judicial appointments for the Federal Court of Appeal and the Tax Court of Canada. Pending Treasury Board approval, funding from Budget 2021 is not included in CAS authorities for the period ending September 30, 2021.

The impacts of COVID-19 and related measures to prevent the spread are expected to continue for the foreseeable future, requiring continued expenditures, such as for distancing, personal protective equipment, increased cleaning and specialized sanitization. In addition, CAS’s increased resourcing costs related to supporting court operations, as well as significant IT costs, including hardware, software and bandwidth in 2020-21, will result in ongoing costs for licenses and maintenance. As such, CAS will require ongoing funding to offset these costs and prevent impacts on its program integrity. As mentioned above, COVID-19 funding provided in Budget 2021 is for 2021-22 only.

The majority of non-personnel expenses incurred by CAS are contracted costs for services supporting the judicial process, court hearings, court security and e-court. They include translation services, protection services, informatics services, court reporters, transcripts, deputy judges, court ushers and court facility rentals. These costs are mostly driven by the number, type and duration of hearings conducted in any given year, which are non-discretionary and limit the organization's financial flexibility.

Risk Management

Funding for CRMS was provided for the Definition Phase to define requirements, initiate digitization activities, and issue a request for proposals prior to advancing to the execution phase of the project. The Definition Phase has been extended to allow for further consultation with the industry and refinement of the project scope and approach. As mentioned above, based on the new risks identified, CAS will need to review the scope and the costing of the project before moving ahead with the next phases.

The outbreak of the COVID-19 pandemic has resulted in governments worldwide enacting emergency measures to combat the spread of the virus. These measures include the implementation of travel bans, quarantine periods and social distancing. The duration and global impact of the COVID-19 outbreak are unknown at this time. During the quarter, CAS supported the Courts in providing critical services and addressing backlogs as applicable. Given that measures to combat the spread of the virus, including hybrid/virtual proceedings and other investments to better support the Courts (e-filing, digital documents, online services), are expected to continue for the foreseeable future, CAS has identified the need for ongoing funding beyond 2021-22.

CAS continues to address the risks to its program integrity, including baselining budgets, establishment of multi-year budgets, reorganizing and realigning services, reallocating resources, and regular reassessment of priorities, exploring alternate funding models while seeking efficiencies wherever possible. The Courts have important facilities requirements that create financial pressures, and CAS is looking at solutions. CAS has developed an efficient Enterprise Risk Management (ERM) process, which includes management participation at the organization’s highest levels. The ERM process allows management to identify, evaluate and mitigate key risks to achieving its mandate and organizational priorities, and drives resource allocation accordingly.

The Chief Justices and CAS have initiated discussions with government officials regarding a potential funding model. In the meantime, CAS has been able to secure additional funding through the budgetary process to address a number of specific pressures in the short term.

Significant changes in relation to operations, personnel and programs

Since its establishment in 2003, CAS has strived to provide timely and efficient service in support of the four Courts while safeguarding judicial independence, a cornerstone of the Canadian judicial system and our democracy. However, the distinct requirements of each Court and the evolving and ongoing demands by Canadians and the legal community for increased modernization of the Courts, including the availability of e-services and translation of federal court decisions, continue to pose considerable challenges for CAS in meeting its core responsibilities with the limited available resources. The COVID-19 pandemic has created additional pressures on CAS’ capacity to ensure efficient and effective modernized and e-enabled services for the Courts, while protecting health and safety.

Approval by Senior Officials

Approved by:

Original signed by

Darlene H. Carreau, LL.B

Chief Administrator

Deputy Head

Original signed by

Jean-Francois Talbot,

Executive Director, Corporate Services

Chief Financial Officer

(Ottawa, Canada)

(November 26, 2021)

| Fiscal year 2021-22 | Fiscal year 2020-21 | |||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 20221 | Used during the quarter ended September 30, 2021 | Year-to-date used at quarter-end | Total available for use for the year ending March 31, 20211 | Used during the quarter ended September 30, 2020 | Year-to-date used at quarter-end | |

| Vote 1 – Operating expenditures | 88,302 | 20,337 | 38,808 | 65,850 | 19,015 | 38,796 |

| Statutory authorities: | ||||||

| Contributions to employee benefit plans | 8,235 | 2,059 | 4,118 | 7,840 | 3,920 | 3,920 |

| Spending of proceeds from the disposal of surplus Crown assets | - | - | - | - | - | - |

| Refunds of amounts credited to revenues in previous years | - | - | - | - | - | - |

| Total budgetary authorities | 96,537 | 22,396 | 42,926 | 73,690 | 22,935 | 42,716 |

1 - Includes only Authorities available for use and granted by Parliament at quarter-end.

| Expenditures: | Fiscal year 2021-22 | Fiscal year 2020-21 | ||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2022 | Expended during the quarter ended September 30, 2021 | Year-to-date used at quarter-end | Planned expenditures for the year ending March 31, 2021 | Expended during the quarter ended September 30, 2020 | Year-to-date used at quarter-end | |

| Personnel | 64,608 | 17,228 | 34,188 | 49,598 | 14,533 | 13,664 |

| Transportation and communications | 2,970 | 531 | 772 | 2,719 | 476 | 734 |

| Information | 482 | 84 | 295 | 437 | 103 | 215 |

| Professional and special services | 15,788 | 2,692 | 3,969 | 10,546 | 2,035 | 3,536 |

| Rentals | 3,028 | 163 | 1,166 | 2,597 | 988 | 1,861 |

| Repair and maintenance | 842 | 71 | 193 | 919 | 6 | 84 |

| Utilities, materials and supplies | 2,814 | 1,158 | 1,728 | 2,176 | 1,446 | 2,022 |

| Acquisition of land, building and works | 2,202 | 179 | 186 | 2,977 | 2,889 | 2,889 |

| Acquisition of machinery and equipment | 3,796 | 287 | 426 | 1,719 | 453 | 705 |

| Other subsidies and payments | 7 | 3 | 3 | 2 | 6 | 6 |

| Total budgetary expenditures | 96,537 | 22,396 | 42,926 | 73,690 | 22,935 | 42,716 |

Groupings can change between quarters due to materiality of initiatives.

Amounts may not balance with other public documents due to rounding.

- Date modified: