Quarterly Financial Report - For the quarter ended September 30, 2019

Statement outlining results, risks and significant changes in operations, personnel and programs

Introduction

This quarterly report should be read in conjunction with the Main Estimates. It has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by Treasury Board. This quarterly report has not been subject to an external audit or review.

The role of the Courts Administration Service (CAS) is to provide effective and efficient administrative services for the federal courts and internal services to the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. Further details on CAS’ programs can be found in the 2019-20 Main Estimates.

Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes CAS’ spending authorities granted by Parliament and those used by the organization consistent with the 2019-20 Main Estimates. This quarterly report has been prepared using a prescribed financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

CAS uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

Highlights of fiscal quarter and fiscal year to date (YTD) results

Significant Changes to Authorities available for use for the fiscal year

As illustrated in the Statement of Authorities and the Departmental Budgetary Expenditures by Standard Object tables at the end of this report, as at September 30, 2019, authorities available for use for the year increased by $14,442 thousand (18%) compared to the same quarter in 2018-19, from $80,649 thousand to $95,091 thousand. As a result of the Government expenditure management cycle and certain conditions imposed by Central Agencies, there are often significant fluctuations by quarter between authorities received and the timing of expenditures realized.

The increase in authorities is mainly related to funding received in Budget 2018 to ensure that Canada's federal Courts, including the Tax Court of Canada, receive adequate support to address a growing and increasingly complex caseload. Funding totaling $9,299 thousand in 2019-20 represents an increase in CAS’s authorities of $4,700 thousand compared to $4,599 thousand in 2018-19.

The increase is also explained by Division 9 proceedings under the Immigration and Refugee Protection Act funding of $3,903 thousand approved on an ongoing basis subsequent to Q2 2018-19.

Through Budget 2019, CAS was granted funding to enhance the integrity of Canada’s Borders and Asylum System. This funding amounts to $4,804 thousand over two years and includes support staff for judges, as well as construction of offices and chambers. $2,635 thousand was allocated in 2019-20 for this initiative.

Budget 2019 included $8,500 thousand over five years for the translation of Courts decisions to Support the Delivery of Justice. CAS has a constitutional and quasi-constitutional obligation to translate decisions rendered by the Courts. This represents funding of $1,700 thousand annually, offset by a decrease of $1,000 thousand related to sun-setting funding, for a net increase of $700 thousand.

Funding was provided in Budget 2018 to implement a new comprehensive Intellectual Property (IP) Strategy to update and modernize Canada’s IP regime. Funding allocated to CAS to improve the efficiency of IP dispute resolution represents an increase of $1,184 thousand for 2019-20.

In addition, CAS accessed additional funding of $428 thousand from the fiscal framework to support efforts related to Mexico Visa Lift initiative. Other increases include $860 thousand in contributions to employee benefit plans (EBP)), $366 thousand due to the operating budget carry-forward being higher than previous year, $182 thousand for compensation, $104 thousand for temporary funding for the implementation of the Program and Administrative Services modernization initiative and $66 thousand related to previous Budget initiatives.

The above increases were partly offset by a $244 thousand for retroactive collective bargaining obligations, $200 thousand in a re-profile of operating sub-allotment to personnel sub-allotment, $197 thousand reduction in our Citizenship revocation funding, as well as a $45 thousand contribution to the implementation of CAS’s departmental financial system.

Note: Budget 2019 funding for the Federal Courthouse in Montreal and a portion of the funding for Canada’s Borders and Asylum System were removed from this publication since CAS hasn’t received approval from the Treasury Board at this time.

Significant Changes to Expenditures

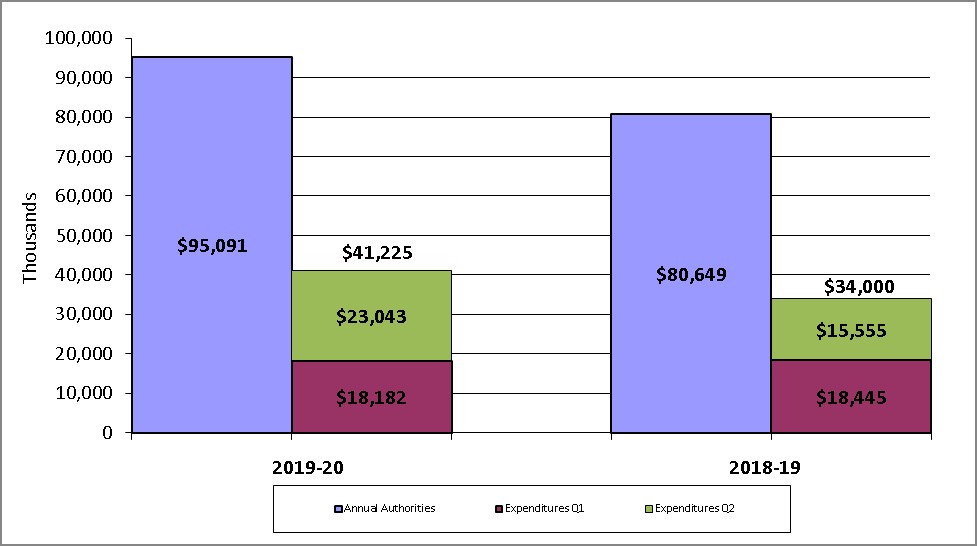

Figure 1 presents current and prior fiscal year expenditures compared to annual authorities, as of at the end of the second quarter. These results are discussed in the section below.

Description of the image

At the end of the second quarter of 2019-20, authorities totalled $95,091 thousand compared to $80,649 thousand at the end of the same quarter of 2018-19.

At the end of the second quarter of 2019-20, expenditures totalled $41,225 thousand compared to $34,000 thousand at the end of the same quarter of 2018-19.

Second-quarter Expenditures

As illustrated in Figure 1, second-quarter expenditures increased by $7,488 thousand (48%) compared to the same quarter in 2018-19, from $15,555 thousand to $23,043 thousand. As a result, 24% of the authorities available for use for the fiscal year were expended during the second quarter of 2019‑20, which reflects a increase of 5% compared to the same quarter of 2018-19.

Also, year-to-date expenditures increased by $7,225 thousand (21%) compared to the same period of the previous fiscal year, from $34,000 thousand to $41,225 thousand. As a result, 43% of the authorities available for use for the fiscal year were expended as of the end of the second quarter of fiscal 2019-20, which reflects an increase of 1% compared to the same period of fiscal year 2018-19.

Significant variances1 are explained as follows:

1 Significant variances are defined as variances by standard object that are greater than $250 thousand or 25%.

Personnel

The year-to-date expenditures related to personnel has increased by $4,164 thousand (16%) compared to same period of the previous fiscal year, from $25,834 thousand to $29,998 thousand. This included a $5,767 thousand (51%) increase in second quarter expenditures compared to the same quarter in 2018-19, from $11,265 thousand to $17,032 thousand. The increase is explained by additional salary and employee benefit plans (EBP) funding obtained in Budget 2018 and Budget 2019 through the specific initiatives detailed in the “Significant Changes to Authorities” section.

Transportation and telecommunications

Year-to-date expenditures related to transportation and telecommunications decreased by $306 thousand (-23%) compared to same period of the previous fiscal year, from $1,338 thousand to $1,032 thousand. This included a $159 thousand (-21%) decrease in second quarter expenditures compared to the same quarter in 2018-19, from $765 thousand to $606 thousand. The decrease is mainly driven by reallocation of expenses related to courier services that will be completed in next quarter.

Information

Year-to-date information expenditures decreased by $193 thousand (-51%) compared to same period of the previous fiscal year, from $376 thousand to $183 thousand. The decrease is mainly due to timing differences in the processing of expenditures between quarters for 2018-19 printing services. This includes a $4 thousand (6%) increase in the second quarter compared to the same quarter of the previous fiscal year, from $62 thousand to $66 thousand.

Professional and special services

Year-to-date expenditures related to professional and special services increased by $2,741 thousand (91%) compared to the same period of the previous fiscal year, from $3,018 thousand to $5,759 thousand. This included a $1,169 thousand (60%) increase in second quarter expenditures compared to the same quarter in 2018-19, from $1,934 thousand to $3,103 thousand. This increase was mainly driven by timing variations relating to the processing of commissionaires invoices in 2018-19 between quarters. This increase is also due to volume increase in translation of Courts decisions to Support the Delivery of Justice as well as information technology and telecommunications consulting expenditures.

Rentals

Year-to-date expenditures related to rentals increased by $599 thousand (57%) compared to same period of the previous fiscal year, from $1,045 thousand to $1,644 thousand. This included a $538 thousand (251%) increase in the second quarter compared to the same quarter of the previous fiscal year, from $214 thousand to $752 thousand. This increase was mainly due to timing variations related to the processing of the expenditures between quarters for 2018-19 rental of office buildings as well as license and maintenance fees for application software.

Repair and maintenance

Year-to-date expenditures related to repair and maintenance decreased by $107 thousand (-50%) compared to same period of the previous fiscal year, from $212 thousand to $105 thousand. This included a $92 thousand (-53%) decrease in second quarter expenditures compared to the same quarter in 2018-19, from $173 thousand to $81 thousand. The decrease is mainly attributable to repairs of communications and networking equipment, and repair of office buildings.

Acquisition of land building and works

Year-to-date expenditures related to acquisition of land building and works increased by $136 thousand (81%) compared to the same period of the previous fiscal year, from $167 thousand to $303 thousand. This increase was mainly driven by the leasehold improvements for reconfiguration of office buildings.

Remaining expenditures (Acquisition of machinery and equipment, utilities, etc.)

For the remaining expenditures, the variances are immaterial and relate mainly to timing of the delivery of goods and services.

Risks and Uncertainties

Funding

The majority of non-personnel expenses incurred by CAS are contracted costs for services supporting the judicial process, court hearings, court security and e-court. They include translation services, protection services, informatics services, court reporters, transcripts, deputy judges, court ushers and court facilities rental. These costs are mostly driven by the number, type and duration of hearings conducted in any given year, are non-discretionary and limit the organization's financial flexibility.

CAS has a limited budget to respond to translation requirements of the courts despite additional funding received. In addition CAS urgently requires additional funding to implement a modern Courts and Registry Management System. As explained in the Risk Management Mitigation Strategies, CAS has received on-going funding to address many other areas of concerns.

Risk Management

To address the risks arising from its program integrity issues, CAS has implemented various strategies, including reorganizing and realigning services, reallocating resources, establishing priorities and regularly reassessing them, as well as seeking efficiencies wherever possible. CAS has developed an efficient Enterprise Risk Management (ERM) process which includes management participation at the highest levels of the organization. The ERM process allows management to identify, evaluate and mitigate key risks to achieving its mandate and organizational priorities, and drives resource allocation accordingly.

The Chief Justices and CAS has initiated discussion with government officials regarding a potential funding model more appropriate to the context of judicial independence. In the meantime, CAS has been able to secure additional funding through the budgetary process to address a number of specific pressures, including program integrity.

Significant changes in relation to operations, personnel and programs

Since its establishment in 2003, CAS has strived to provide timely and efficient service in support of the four Courts while safeguarding judicial independence; a cornerstone of the Canadian judicial system and our democracy. However, the distinct requirements of each Court and the evolving and ongoing demands by Canadians and the legal community for increased availability of e-services and translation continue to pose considerable challenges for CAS in meeting its core responsibilities with the limited available resources.

The priority placed on technology-enabled courts, as well as the continued security of the Courts and their members warrant that they be recognized as programs in themselves. As such in 2018–19, CAS’s Departmental Results Framework brings significant changes in relation to its programs and will now include e-courts and court security, in addition to the judicial and registry programs. This will effectively respond to the current, unique needs of the Courts and allow CAS to better measure and report on results in these areas. This change will represent a reduction in internal services and a corresponding increase in administration services for the federal courts, due to realignment of security and e-courts resources.

In 2019–20, the focus will continue to be placed on enhancing court and registry technologies to allow access to court services electronically, continuing to enhance physical and information technology security, ensuring the space requirements of the Courts are met, and facilitating the timely translation and posting of court decisions on websites of the Courts.

Approval by Senior Officials

Approved by:

Original signed by

Daniel Gosselin, FCPA,

FCA

Chief Administrator

Deputy Head

Original signed by

Francine Côté, CPA, CA,

CISA

Deputy Chief Administrator, Corporate Services

Chief Financial Officer

(Ottawa, Canada)

(November 29, 2019)

| Fiscal year 2019-20 | Fiscal year 2018-19 | |||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 20201 | Used during the quarter ended September 30, 2019 | Year-to-date used at quarter-end | Total available for use for the year ending March 31, 20191 | Used during the quarter ended September 30, 2018 | Year-to-date used at quarter-end | |

| Vote 1 – Operating expenditures | 87,121 | 21,080 | 37,298 | 73,658 | 13,943 | 30,776 |

| Statutory authorities: | ||||||

| Contributions to employee benefit plans | 7,970 | 1,962 | 3,926 | 6,991 | 1,612 | 3,224 |

| Spending of proceeds from the disposal of surplus Crown assets | - | - | - | - | - | - |

| Refunds of amounts credited to revenues in previous years | - | 1 | 1 | - | - | - |

| Total budgetary authorities | 95,091 | 23,043 | 41,225 | 80,649 | 15,555 | 34,000 |

1- Includes only Authorities available for use and granted by Parliament at quarter-end.

| Expenditures: | Fiscal year 2019-20 | Fiscal year 2018-19 | ||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2020 | Expended during the quarter ended September 30, 2019 | Year-to-date used at quarter-end | Planned expenditures for the year ending March 31, 2019 | Expended during the quarter ended September 30, 2018 | Year-to-date used at quarter-end | |

| Personnel | 59,827 | 17,032 | 29,998 | 52,903 | 11,265 | 25,834 |

| Transportation and communications | 3,229 | 606 | 1,032 | 2,634 | 765 | 1,338 |

| Information | 533 | 66 | 183 | 429 | 62 | 376 |

| Professional and special services | 15,182 | 3,103 | 5,759 | 11,839 | 1,934 | 3,018 |

| Rentals | 1,784 | 752 | 1,644 | 1,461 | 214 | 1,045 |

| Repair and maintenance | 1,053 | 81 | 105 | 1,003 | 173 | 212 |

| Utilities, materials and supplies | 2,641 | 574 | 1,350 | 2,191 | 341 | 1,130 |

| Acquisition of land, building and works | 5,329 | 303 | 303 | 3,570 | 167 | 167 |

| Acquisition of machinery and equipment | 5,506 | 478 | 753 | 4,611 | 539 | 757 |

| Other subsidies and payments | 7 | 48 | 98 | 8 | 95 | 123 |

| Total budgetary expenditures | 95,091 | 23,043 | 41,225 | 60,649 | 15,555 | 34,000 |

Groupings can change between quarters due to materiality of initiatives.

Amounts may not balance with other public documents due to rounding.

- Date modified: