Quarterly Financial Report - For the quarter ended June 30, 2018

Statement outlining results, risks and significant changes in operations, personnel and programs

Introduction

This quarterly report should be read in conjunction with the Main Estimates. It has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by Treasury Board. This quarterly report has not been subject to an external audit or review.

The role of the Courts Administration Service (CAS) is to provide effective and efficient administrative services for the federal courts and internal services to the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. Further details on CAS’ programs can be found in the 2018-19 Main Estimates.

Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes CAS’ spending authorities granted by Parliament and those used by the organization consistent with the 2018-19 Main Estimates. This quarterly report has been prepared using a prescribed financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

CAS uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

Highlights of fiscal quarter and fiscal year to date (YTD) results

Significant Changes to Authorities available for use for the fiscal year

As illustrated in the Statement of Authorities and the Departmental Budgetary Expenditures by Standard Object tables at the end of this report, as at June 30, 2018, authorities available for use for the year increased by $2,575 thousand (3%) compared to the same quarter in 2017-18, from $75,249 thousand to $77,824 thousand. As a result of the Government expenditure management cycle and certain conditions imposed by Central Agencies, there are often significant fluctuations by quarter between authorities received and the timing of expenditures realized.

The increase in authorities is mainly due to $4,599 thousand in funding received in Budget 2018 to ensure that Canada's federal Courts, including the Tax Court of Canada, receive adequate support to address a growing and increasingly complex caseload. The increase is also due to $1,000 thousand received in Budget 2017 to support the translation of decisions of the federal Courts and due to the compensation for collective bargaining of $1,390 thousand which had not been received at the end of the first quarter of the previous year. The authorities also include $780 thousand in funding to enhance procedural fairness in the citizenship revocation process under the Citizenship Act which remains frozen and inaccessible until a judicial appointment is made.

In addition, there was an increase of $334 thousand in contributions to employee benefit plans compared to 2017-18 and increases in funding of $27 thousand for enhancements to physical and information technology (IT) security for the federal Courts, of $25 thousand in funding to invest in information technology (IT) infrastructure upgrades to safeguard the efficiency of the federal court system and finally, of $19 thousand in funding for the Mexico visa lift initiative.

The above increases were partly offset by a decrease of $3,957 thousand for the pending renewal of Division 9 proceedings under the Immigration and Refugee Protection Act (Balanced Refugee Reform Act), as well as a decrease of $1,642 thousand due to the completion of the relocation of the Québec City Office.

Other minor changes resulted in a net decrease of $1 thousand in authorities.

Significant Changes to Expenditures

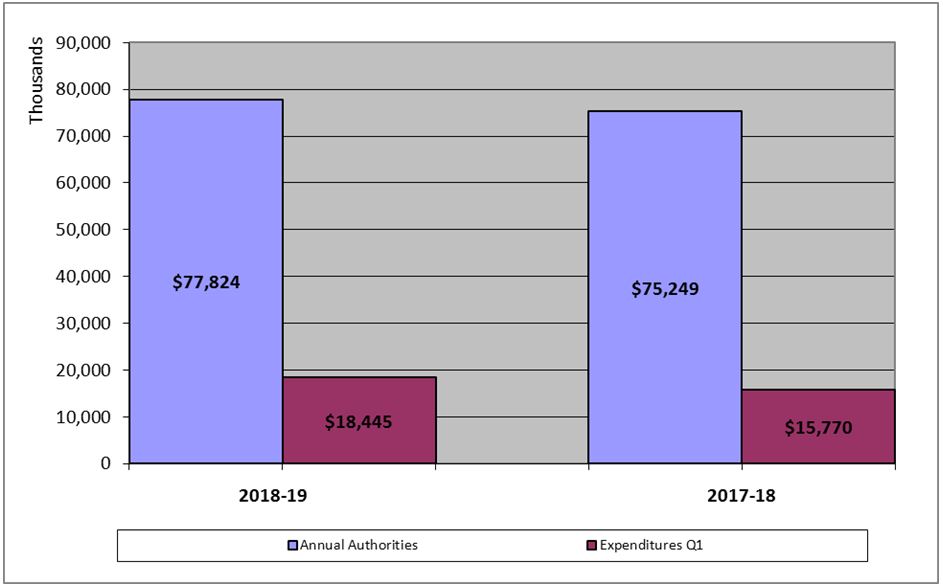

Figure 1 presents current and prior fiscal year expenditures compared to annual authorities, as of the end of the first quarter. These results are discussed in the section below.

Description of the image

At the end of the first quarter of 2018-19, authorities totalled $77,824 thousand compared to $75,249 thousand at the end of the same quarter of 2017-18.

At the end of the first quarter of 2018-19, expenditures totalled $18,445 thousand compared to $15,770 thousand at the end of the same quarter of 2017-18.

First-quarter Expenditures

As illustrated in Figure 1, first-quarter expenditures increased by $2,675 thousand (17%) compared to the same quarter in 2017-18, from $15,770 thousand to $18,445 thousand. As a result, 24% of the authorities available for use for the fiscal year were expended during the first quarter of 2018-19, which reflects a minor increase of 3% compared to the same quarter of 2017-18.

Significant variances1 are explained as follows:

Personnel

Year-to date expenditures related to personnel increased by $1,897 thousand (15%) compared to same period of the previous fiscal year, from $12,672 thousand to $14,569 thousand. This increase is largely driven by increases in full time equivalents and by the signature of the new collective agreements which resulted in retroactive pay as well as increases in salaries.

Utilities, materials and supplies

Year-to date expenditures related to utilities, materials and supplies increased by $233 thousand (42%) compared to same period of the previous fiscal year, from $556 thousand to $789 thousand. This increase is explained by higher volume of purchases of office and stationery supplies.

Rentals

Year-to-date expenditures related to rentals increased by $209 thousand (34%) compared to same period of the previous fiscal year, from $622 thousand to $831 thousand. This increase was due to timing variations related to the processing of the expenditures between quarters.

Information

Year-to date expenditures related to information increased by $122 thousand (64%) compared to same period of the previous fiscal year, from $192 thousand to $314 thousand. This increase is explained by timing differences in the processing of expenditures between quarters for printing services.

Acquisition of machinery and equipment

Year-to date expenditures related to acquisition of machinery and equipment increased by $85 thousand (64%) compared to same period of the previous fiscal year, from $133 thousand to $218 thousand. This increase was mainly driven by timing variations related to the processing of expenditures between quarters for the purchase of informatics equipment and parts for IT-related projects and initiatives.

Other subsidies and payments

Year-to date expenditures related to other subsidies and payments increased by $28 thousand (100 %) compared to same period of the previous fiscal year, from zero to $28. This increase is mainly due to timing variances.

Repair and maintenance

Year-to date expenditures related to repair and maintenance increased by $15 thousand (63%) compared to same period of the previous fiscal year, from $24 thousand to $39 thousand. The increase is explained by timing differences in both repairs of building and purchases of informatics equipment and parts for IT related projects and initiatives.

Immaterial variances, including minor variations in the timing of the delivery of goods and services accounts for the remaining variances compared to same period of the previous fiscal year.

Risks and Uncertainties

Funding

The majority of non-personnel expenses incurred by CAS are contracted costs for services supporting the judicial process and court hearings. They include translation, court reporters, transcripts, and security services, and they are mostly driven by the number, type and duration of hearings conducted in any given year. These are non-discretionary and limit the organization's financial flexibility.

CAS has been facing a program integrity situation for many years, which has resulted from various ongoing pressures and has impacted CAS' ability to deliver its core mandate while meeting legislative and policy requirements. Furthermore, external drivers that influence costs, such as inflation and government cost-saving measures, have represented additional challenges. Although it is an important priority for the courts and their users, CAS has been unable to procure and implement a modern court and registry management system to replace unreliable legacy systems and support the transition to fully electronic services. CAS also has a limited budget to respond to translation requirements of the courts. As explained in the Risk Management mitigation strategies, CAS has received funding to address many of the areas of concerns; securing additional funding for future years is still a priority.

Risk Management

To address the risks arising from its program integrity issues, CAS has implemented various strategies, including reorganizing and realigning services, reallocating resources, establishing priorities and regularly reassessing them, as well as seeking efficiencies wherever possible. Having assessed a number of different financial models, CAS has been able to secure additional funding through the budgetary process to address many of the pressures.

As a result of these efforts, Budget 2015 provided funding of $19 million over five years as well as ongoing funding specifically to enhance CAS' physical and IT security. Budget 2016 then provided $7.9 million over five years, as well as ongoing funding, to invest in IT infrastructure upgrades to safeguard the efficiency of the federal court system. Budget 2016 provided $2.6 million over two years to relocate the Québec City Office, thereby ensuring continued federal Courts presence in that location.

Budget 2017 provided $2 million over two years to enhance the federal Courts’ ability to make decisions available in both English and French. CAS also received one-time off-cycle funding of $4 million in 2017-18 to address urgent program integrity issues to help ensure the continued integrity of Canada’s federal Courts.

Budget 2018 recently announced funding of $41.9 million over 5 years, starting 2018-19, as well as ongoing funding, to ensure that Canada’s federal Courts, including the Tax Court of Canada, receive adequate support to address a growing and increasingly complex caseload. This investment includes support for new front-line registry and judicial staff.

Outstanding pressures to address include the court and registry management system and translation of court decisions.

Significant changes in relation to operations, personnel and programs

Since its establishment in 2003, CAS has strived to provide timely and efficient service in support of the four Courts while safeguarding judicial independence—a cornerstone of the Canadian judicial system and our democracy. However, the distinct requirements of each Court and the evolving and ongoing demands by Canadians and the legal community for increased availability of e-services continue to pose considerable challenges for CAS in meeting its core responsibilities with the limited available resources.

The priority placed on technology-enabled courts, as well as the continued security of the Courts and their members warrant that they be recognized as programs in themselves. As such in 2018–19, CAS’s Departmental Results Framework brings significant changes in relation to its programs and will now include e-courts and security, in addition to the judicial and registry programs. This will effectively respond to the current, unique, needs of the Courts and allow CAS to better measure and report on results in these areas. This change will represent a reduction in internal services and a corresponding increase in administration services for the federal courts, due to realignment of security and e-courts resources.

In 2018–19 particular focus will be placed on enhancing court and registry technologies to allow access to court services electronically, continuing to enhance physical and information technology security, ensuring the space requirements of the Courts are met, and facilitating the timely translation and posting of court decisions on websites of the Courts.

There have been no significant changes in CAS operations and personnel.

Approval by Senior Officials

Approved by:

Original signed by

Daniel Gosselin, FCPA, FCA

Chief Administrator

Deputy Head

Original signed by

Francine Côté, CPA, CA, CISA

Deputy Chief Administrator, Corporate Services

Chief Financial Officer

(Ottawa, Canada)

(August 29, 2018)

| Fiscal year 2018-19 | Fiscal year 2017-18 | |||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 20191 | Used during the quarter ended June 30, 2018 | Year-to-date used at quarter-end | Total available for use for the year ending March 31, 20181 | Used during the quarter ended June 30, 2017 | Year-to-date used at quarter-end | |

| Vote 1 – Operating expenditures | 70,833 | 16,833 | 16,833 | 68,590 | 14,104 | 14,104 |

| Statutory authorities: | ||||||

| Contributions to employee benefit plans | 6,991 | 1,612 | 1,612 | 6,657 | 1,664 | 1,664 |

| Spending of proceeds from the disposal of surplus Crown assets | - | - | - | - | - | - |

| Refunds of amounts credited to revenues in previous years | - | - | - | 2 | 2 | 2 |

| Total budgetary authorities | 77,824 | 18,445 | 18,445 | 75,249 | 15,770 | 15,770 |

1- Includes only Authorities available for use and granted by Parliament at quarter-end.

| Expenditures: | Fiscal year 2018-19 | Fiscal year 2017-18 | ||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2019 | Expended during the quarter ended June 30, 2018 | Year-to-date used at quarter-end | Planned expenditures for the year ending March 31, 2018 | Expended during the quarter ended June 30, 2017 | Year-to-date used at quarter-end | |

| Personnel | 52,124 | 14,569 | 14,569 | 49,058 | 12,672 | 12,672 |

| Transportation and communications | 2,634 | 573 | 573 | 2,989 | 462 | 462 |

| Information | 429 | 314 | 314 | 503 | 192 | 192 |

| Professional and special services | 10,921 | 1,084 | 1,084 | 10,671 | 1,109 | 1,109 |

| Rentals | 1,461 | 831 | 831 | 1,713 | 622 | 622 |

| Repair and maintenance | 1,003 | 39 | 39 | 1,112 | 24 | 24 |

| Utilities, materials and supplies | 2,191 | 789 | 789 | 2,569 | 556 | 556 |

| Acquisition of land, building and works | 2,536 | 0 | 0 | 2,265 | 0 | 0 |

| Acquisition of machinery and equipment | 4,517 | 218 | 218 | 4,358 | 133 | 133 |

| Other subsidies and payments | 8 | 28 | 28 | 11 | 0 | 0 |

| Total budgetary expenditures | 77,824 | 18,445 | 18,445 | 75,249 | 15,770 | 15,770 |

1 Significant variances are defined as variances by standard object that are greater than $250 thousand or 25%.

- Date modified: