Quarterly Financial Report - For the quarter ended September 30, 2017

Statement outlining results, risks and significant changes in operations, personnel and programs

Introduction

This quarterly report should be read in conjunction with the Main Estimates. It has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by Treasury Board. This quarterly report has not been subject to an external audit or review.

The role of the Courts Administration Service (CAS) is to provide effective and efficient registry, judicial and corporate services to the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. Further details on CAS’ programs can be found in the 2017-18 Main Estimates. .

Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes CAS’ spending authorities granted by Parliament and those used by the organization consistent with the 2017-18 Main Estimates. This quarterly report has been prepared using a prescribed financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

CAS uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

Highlights of fiscal quarter and fiscal year to date (YTD) results

Significant Changes to Authorities available for use for the fiscal year

As illustrated in the Statement of Authorities and the Departmental Budgetary Expenditures by Standard Object tables at the end of this report, as at September 30, 2017, authorities available for use for the year increased by $4,496 thousand (6%) compared to the same quarter in 2016-17, from $73,816 thousand to $78,312 thousand. As a result of the Government expenditure management cycle and certain conditions imposed by Central Agencies, there are often significant fluctuations by quarter between authorities received and the timing of expenditures realized.

This increase in authorities is partly due to $1,490 thousand in funding received in Budget 2016 to invest in information technology (IT) infrastructure upgrades to safeguard the efficiency of the federal court system. Also, $1,642 thousand was received in Budget 2016 to relocate the Québec City Office, thereby ensuring continued Federal Courts presence in that city.

Although $740 thousand in funding for the Mexico visa lift initiative is now included in the 2017-18 authorities, it will remain frozen and inaccessible until a judicial appointment is made. The final repayment related to the one-time funding received in fiscal year 2011–12 to replace the aging data centre was made in 2016-17, resulting in an increase of $551 thousand in 2017-18 reference level. Finally, the operating budget carry-forward increased by $1,602 thousand between 2016-17 and 2017-18 and compensation for collective bargaining increases of $113 thousand had not been received at the end of the second quarter of the previous fiscal year.

The above increases were partly offset by a $1,040 thousand decrease in funding received in Budget 2015 for enhancements to physical and information technology (IT) security for the Federal Courts, and a $495 thousand decrease in contributions to employee benefit plans. Additionally, there was a decrease of $104 thousand related to a government-wide reduction in marketing, professional services, and travel.

Other minor changes resulted in a net decrease of $3 thousand in authorities.

Significant Changes to Expenditures

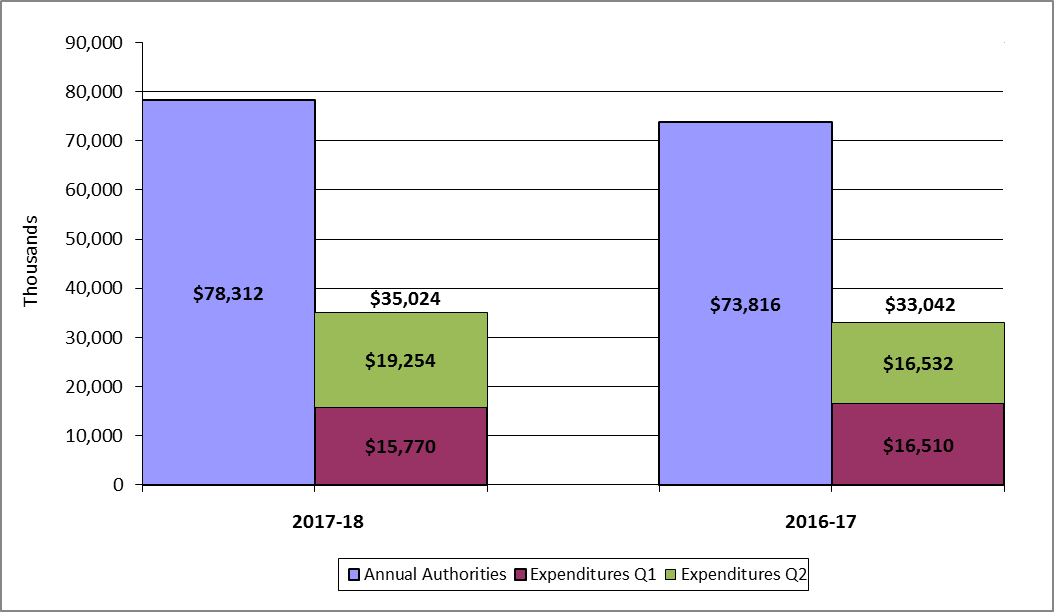

Figure 1 presents current and prior fiscal year expenditures compared to annual authorities, as of the end of the second quarter. These results are discussed in the section below.

Figure 1 – Expenditures Compared to Annual Authorities

Description of the image

Figure 1 – Expenditures Compared to Annual Authorities

At the end of the second quarter of 2017-18, authorities totaled $78,312 thousand compared to $73,816 thousand at the end of the same quarter of 2016-17.

During the first quarter of 2017-18, expenditures totaled $15,770 thousand compared to $16,510 thousand during the same quarter of 2016-17.

During of the second quarter of 2017-18, expenditures totaled $19,254 thousand compared to $16,532 thousand during the second quarter of 2016-17.

Second quarter Expenditures

As illustrated in Figure 1, second quarter expenditures increased by $2,722 thousand (16%) compared to the same quarter in 2016-17, from $16,532 thousand to $19,254 thousand. As a result, 25% of the authorities available for use for the fiscal year were expended during the second quarter of 2017-18, which reflects a minor increase of 3% compared to the same quarter in 2016-17.

Also, year-to-date expenditures increased by $1,982 thousand (6%) compared to the same period of the previous fiscal year, from $33,042 thousand to $35,024 thousand. As a result, 45% of the authorities available for use for the fiscal year were expended as of the end of the second quarter of fiscal 2017-18, which is consistent with the same period of the previous fiscal year 2016-17.

Significant variances1 are explained as follows:

Personnel:

Year-to-date personnel expenditures increased by $2,889 thousand (11%) compared to same period of the previous fiscal year, from $25,368 thousand to $28,257 thousand. This included a $2,946 thousand (23%) increase in second quarter expenditures compared to the same quarter in 2016-17, from $12,639 thousand to $15,585 thousand. The increases in year-to-date and second quarter personnel expenditures were principally driven by the retroactive pay as a result of the new collective agreements.

Professional and special services:

Year-to-date expenditures related to professional and special services decreased by $778 thousand (-23%) compared to same period of the previous fiscal year, from $3,316 thousand to $2,538 thousand. This included a $465 thousand (-25%) decrease in second quarter expenditures compared to the same quarter in 2016-17, from $1,894 thousand to $1,429 thousand. This decrease was mainly driven by timing variations related to processing of expenditures related to translation services during this quarter and a decrease in IT and telecommunications consulting expenditures and business services related to hearings.

Acquisition of machinery and equipment:

Year-to-date expenditures related to acquisition of machinery and equipment decreased by $505 thousand (-56%) compared to same period of the previous fiscal year, from $904 thousand to $399 thousand. The majority of this stemmed from the first quarter. The year-to-date decrease was mainly driven by timing variations related to the processing of expenditures between quarters for the purchase of informatics equipment and parts for IT-related projects and initiatives.

Rentals

Year-to-date expenditures related to rentals increased by $436 thousand (62%) compared to same period of the previous fiscal year, from $705 thousand to $1,141 thousand. This included a $237 thousand (84%) increase in the second quarter compared to the same quarter of the previous fiscal year, from $282 thousand to $519 thousand. This increase was due to both rental of additional office space in relation to the physical security enhancements initiative as well as timing variations related to the processing of the expenditures between quarters.

Repair and maintenance:

Year-to-date expenditures related to repair and maintenance decreased by $151 thousand (-63%) compared to same period of the previous fiscal year, from $239 thousand to $88 thousand. This included a $91 thousand (-59%) decrease in second quarter expenditures compared to the same quarter in 2016-17, from $155 thousand to $64 thousand. The decrease is mainly attributable to decreases in repairs of office buildings.

Acquisition of land, building and works:

Year-to-date expenditures related to acquisition of land, building and works increased by $106 thousand (312%) compared to same period of the previous fiscal year, from $34 thousand to $140 thousand. This included a $110 thousand (364%) increase in the second quarter compared to the same quarter of the previous fiscal year, from $30 thousand to $140 thousand. This increase was mainly due to leasehold improvements for the head office building and installation of court screening equipment.

Information:

Year-to-date information expenditures increased by $68 thousand (28%) compared to same period of the previous fiscal year, from $244 thousand to $312 thousand. This included a $48 thousand (67%) increase in the second quarter compared to the same quarter of the previous fiscal year, from $72 thousand to $120 thousand. This increase was mainly due to increases in printing services.

Other subsidies and payments:

Year-to-date expenditures related to other subsidies and payments increased by $29 thousand (536 %) compared to same period of the previous fiscal year, from $6 thousand to $35 thousand. This included a $49 thousand (343%) increase in the second quarter compared to the same quarter of the previous fiscal year, from -$14 thousand to $35 thousand. This increase is mainly due to timing variances.

Immaterial variances, including minor variations in the timing of the delivery of goods and services account for the remaining variances in year-to-date and second quarter expenditures compared to the previous fiscal year.

Risks and Uncertainties

Funding

The majority of non-personnel expenses incurred by CAS are contracted costs for services supporting the judicial process and court hearings. They include translation, court reporters, transcripts, and security services, and they are mostly driven by the number, type and duration of hearings conducted in any given year. These are non-discretionary and limit the organization's financial flexibility.

CAS has been facing a program integrity situation for many years, which has resulted from various ongoing pressures and has impacted CAS’ ability to deliver its core mandate while meeting legislative and policy requirements. Although it is an important priority for the courts and their users, CAS has been unable to procure and implement a modern court and registry management system to replace unreliable legacy systems and support the transition to fully electronic services. CAS also has a limited budget to respond to increases in the resources required to support the judicial process and translation costs, which result from increases in the quantity and complexity of court cases, as well as increases in the number of self-representing litigants who require more assistance. Furthermore, external drivers that influence costs, such as inflation and government cost-saving measures, represent additional challenges.

Risk Management

To address the risks arising from its program integrity issues, CAS has implemented various strategies, including reorganizing and realigning services, reallocating resources, establishing priorities and regularly reassessing them, as well as seeking efficiencies wherever possible. Having assessed a number of different financial models, CAS is trying to secure additional funding. CAS received some program integrity funding in Budget 2015 specifically for physical and IT security.

Budget 2016 provided $7.9 million over five years, as well as ongoing funding, to invest in IT infrastructure upgrades to safeguard the efficiency of the federal court system. Budget 2016 also provided up to $2.6 million over two years on a cash basis to relocate the Québec City Office.

CAS received in-year funding of $4 million to address urgent program integrity issues. CAS continues to work with central agencies to address program integrity on an ongoing basis.

Significant changes in relation to operations, personnel and programs

There have been no significant changes in CAS operations, personnel and programs.

Approval by Senior Officials

Approved by:

Original signed by

Daniel Gosselin, FCPA, FCA

Chief Administrator

Deputy Head

Original signed by

Francine Côté, CPA, CA, CISA

Deputy Chief Administrator, Corporate Services

Chief Financial Officer

(Ottawa, Canada)

(November 29, 2017)

| Fiscal year 2017-18 | Fiscal year 2016-17 | |||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 20181 | Used during the quarter ended September 30, 2017 | Year-to-date used at quarter-end | Total available for use for the year ending March 31, 20171 | Used during the quarter ended September 30, 2016 | Year-to-date used at quarter-end | |

| Vote 1 – Operating expenditures | 71,653 | 17,589 | 31,694 | 66,660 | 14,742 | 29,462 |

| Statutory authorities: | ||||||

| Contributions to employee benefit plans | 6,657 | 1,664 | 3,328 | 7,152 | 1,788 | 3,576 |

| Spending of proceeds from the disposal of surplus Crown assets | - | - | - | - | - | - |

| Refunds of amounts credited to revenues in previous years | 2 | 1 | 2 | 4 | 2 | 4 |

| Total budgetary authorities | 78,312 | 19,254 | 35,024 | 73,816 | 16,532 | 33,042 |

1- Includes only Authorities available for use and granted by Parliament at quarter-end.

| Expenditures: | Fiscal year 2017-18 | Fiscal year 2016-17 | ||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2018 | Expended during the quarter ended September 30, 2017 | Year-to-date used at quarter-end | Planned expenditures for the year ending March 31, 2017 | Expended during the quarter ended September 30, 2016 | Year-to-date used at quarter-end | |

| Personnel | 49,058 | 15,585 | 28,257 | 48,734 | 12,639 | 25,368 |

| Transportation and communications | 2,989 | 683 | 1,145 | 2,844 | 706 | 1,216 |

| Information | 503 | 120 | 312 | 326 | 72 | 244 |

| Professional and special services | 10,821 | 1,429 | 2,538 | 11,824 | 1,894 | 3,316 |

| Rentals | 2,613 | 519 | 1,141 | 2,675 | 282 | 705 |

| Repair and maintenance | 1,112 | 64 | 88 | 1,333 | 155 | 239 |

| Utilities, materials and supplies | 2,569 | 413 | 969 | 2,335 | 495 | 1,010 |

| Acquisition of land, building and works | 3,777 | 140 | 140 | 370 | 30 | 34 |

| Acquisition of machinery and equipment | 4,858 | 266 | 399 | 3,371 | 273 | 904 |

| Other subsidies and payments | 12 | 35 | 35 | 4 | -14 | 6 |

| Total budgetary expenditures | 78,312 | 19,254 | 35,024 | 73,816 | 16,532 | 33,042 |

1 Significant variances are defined as variances by standard object that are greater than $250 thousand or 25%.

- Date modified: