Departmental Results Report 2022–23

The Departmental Results Report (DRR) is published in PDF and HTML formats.

The Honourable Arif Virani, P.C., M.P.

Minister of Justice and Attorney General of Canada

Table of Contents

From the Chief Administrator and Chief Executive Officer

- Spending

- Human resources

- Expenditures by vote

- Government of Canada spending and activities

- Financial statements and financial statements highlights

- Organizational profile

- Raison d’être, mandate and role: who we are and what we do

- Operating context

- Reporting framework

Supporting information on the program inventory

Supplementary information tables

Organizational contact information

From the Chief Administrator and Chief Executive Officer

It is my pleasure to present the 2022–23 Departmental Results Report for the Courts Administration Service (CAS). CAS is a small department within the portfolio of the Minister of Justice that provides registry, judicial and corporate services to our 4 federally-constituted courts: the Federal Court of Appeal (FCA), the Federal Court (FC), the Court Martial Appeal Court (CMAC) and the Tax Court of Canada (TCC), known collectively as the Courts. It is playing a pivotal role in supporting the cost-effective delivery of justice to all Canadians, bolstering public trust in Canadian institutions and the rule of law, while also safeguarding judicial independence.

2023 marks CAS’s 20th anniversary. The past 2 decades have ushered in significant changes, both in the expectations of those turning to the Courts and in the range of technological advancements that are available to streamline court operations and improve service delivery.

This report highlights CAS’s achievements over the past fiscal year. I am proud to report that we continued to build on the innovative responses that we deployed in the pandemic to sustain and reimagine court administration. In 2022–23, CAS received an historic-level investment of $248M over 5 years to modernize and expand our court facilities across Canada. These important investments will ensure Canadians will have access to modern, equipped, digitally-enabled, accessible and secure court facilities across Canada for many years to come. Furthermore, we continued to prioritize the attraction, development, and retention of a high-performing and diverse workforce, and we implemented measures to further instill a service culture and a client-centric mindset.

In some cases, these achievements are associated with significant challenges from previous years that CAS continues to navigate. CAS was forced to revisit its approach to digital modernization, take stock of important lessons learned and address identified risks. Generally, we needed to establish a better, more resilient foundation to ensure future success. While such efforts are rarely glamorous, I believe that the work we have invested in this past year will pay dividends in the coming years.

CAS is a small organization with an ambitious agenda, operating in a complex environment with limited funding. In an age of constant change—where collectively Canadians and their institutions are navigating new technologies, evolving geopolitics and a challenging economy—CAS will continue to exercise sound financial stewardship while being innovative, agile, and resilient. Several measures are underway and will continue into 2023–24 to address specific funding pressures and work towards a more sustainable funding base. We are cognizant that without concerted efforts to both realize efficiencies and make the case for increased funding, there is a risk that current funding levels could impact our ability to meet the changing needs of the judiciary and Canadians, and ultimately undercut judicial independence and the rule of law. We are urgently seized with this work as a result.

We are commemorating our 20th anniversary by celebrating our achievements in support of our mandate, while also reflecting on the opportunities that lie ahead. More than 10% of our employees have worked at CAS since its creation; this is a testament to their dedication. I am incredibly proud of our workforce, particularly how every employee contributes to our success. From coast to coast to coast, we work together to ensure that Canadians have access to, and trust in, a fair, efficient, and effective justice system.

CAS has benefited immeasurably from the ongoing collaboration and support of the judiciary we serve. I extend my sincere gratitude to them, to my executive team, and to the dedicated employees of CAS who are key to our efforts to preserve and enhance access to justice, rule of law, independence of the courts and the public’s trust—fundamental principles of democracy that breathe life into Canada’s judicial branch of government.

Darlene H. Carreau LL.B.

Chief Administrator

Results at a glance

2022–23 was a pivot year for the Courts Administration Service (CAS), where we exited the pandemic and started to prioritize longer-term strategic planning, strengthening our foundations, and building on lessons learned. In so doing, we were guided by our 4 strategic priorities: digital courts; workforce of the future; national courthouses and court facilities; and service excellence. This Departmental Results Report highlights CAS’s achievements and initiatives in these areas.

Digital courts — Deliver information technology solutions that provide for the effective management of court business, offer self-service to litigants and improve access to justice.

Along with CAS’s regular maintenance of existing systems, we delivered better digital solutions using modern practices to improve court operations, including:

- e-stamping – enabling an electronic mechanism to stamp all court documents thereby further reducing the reliance on paper, including for the TCC’s Appeals System Plus case management system

- e-courtrooms – upgrading courtrooms so that they are equipped to handle digital hearings; CAS now has 16 e-courtrooms, 6 of which were established in the 2022–23 fiscal year

- e-filing – making certain court documents available to the public, increasing the availability of information.

- virtual proceedings – allowing for the public and the Court to participate in virtual hearings, reducing the workload of the Registry

- TCC virtual proceedings – allowing for the public and the Court to participate in virtual hearings, reducing the workload of the Registry

National courthouses and court facilities — Deliver modern, equipped, accessible and secure federal court facilities across Canada.

In 2022–23, CAS secured significant investments and set out a multi-year plan, referred to as the National Courts Facilities Modernization Program (NCFMP). The scope of the NCFMP work is considerable and will be staged over 5 years. In 2022–23, we completed the following:

- conceptual design work for the new National Judicial Complex in Montréal

- enabling work in Toronto, including completing the first draft of the functional program, installing a high-density shelving system, studying vertical transportation, and painting public areas in need of a refresh

- pre-implementation planning for projects in Halifax, Ottawa, Southern Ontario, Winnipeg, Saskatoon and Victoria

Throughout the year, many smaller-scale, though necessary, facilities improvements were completed, including refreshing of the Fredericton and Vancouver court facilities, and constructing new judicial chambers in Ottawa.

Workforce of the future — Attract, retain and develop a highly- skilled, diverse and engaged workforce. Optimize our work environment and strengthen management excellence.

In 2022–23, CAS undertook initiatives to ensure it had the right people in place with the right skills to meet the Courts’ needs. Highlights for the fiscal year 2022–23 included:

- streamlining staffing processes to gain efficiencies, for example, establishing collective hiring processes to create perpetual pools, as well as standing inventories for difficult to staff positions

- emphasizing both mental health and a psychologically-healthy and safe environment, particularly through the leadership of the Mental Health Champion and specialized training sessions on topics such as self-care, resilience and coping with stress

- launching CAS’s Diversity, Inclusion and Anti-Racism Committee, establishing gender-neutral washrooms, renewing art installations within CAS facilities, and reviewing internal documentation such as policy instruments, plans, and tools

Service excellence – Provide consistent, quality and timely client-centric services. Modernize our practices, processes and tools and integrate new business and technological solutions.

In 2022–23, CAS continued to focus on driving a cultural shift towards service excellence. Initiatives for the past fiscal year included:

- conducting a service review of immigration registry services and identifying opportunities to enhance and reimagine service delivery over the coming years

- establishing a new data science team and developing a preliminary data strategy to unlock the value of data as a strategic asset, including to continuously inform and improve service delivery

- reinvigorating strategic planning, risk management, governance, and supporting the stabilizing and re-establishing of more regular court operations

For more information on the CAS’s plans, priorities and results achieved, see the “Results: what we achieved” section of this report.

Results: what we achieved

Core responsibility

Administration services for the federal Courts

Description

CAS provides timely and efficient judicial, registry, court security and electronic court services to the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada; coordinate the provision of services among the 4 courts; and safeguard the independence of the Courts by placing administrative services at arm’s length from the Government of Canada.

Results

CAS’s mandate is firmly anchored in access to justice, given the prerogative to both safeguard judicial independence and realize the effective and efficient provision of administrative services. In addition, each of our strategic priorities—digital courts, workforce of the future, national courthouses and court facilities, and service excellence—are designed to prioritize access to justice for all those who turn to the Canadian justice system.

Digital courts — Deliver information technology solutions that provide for the effective management of court business, offer self-service to litigants and improve access to justice.

In 2019, CAS launched a multi-year project to implement a new Courts and Registry Management System (CRMS) that would replace its legacy systems and enable the electronic management of court business. Almost immediately thereafter, CAS was confronted by the COVID-19 pandemic and was forced to fast track the implementation of a range of measures and technologies to deliver justice remotely and ensure continuity of court operations. While the solutions that were implemented aimed to meet urgent needs, they were seldom the best foundation on which to build a sustainable digital future or realize efficiencies and meet the expectations of the judiciary and Canadians.

In the summer of 2022, CAS closed the current iteration of the CRMS Project Definition phase to absorb lessons learned and determine a more viable way forward; one that would be more user-centric, iterative, and aligned with the Government of Canada’s Digital AmbitionFootnote i and requirements of the Policy on Service and DigitalFootnote ii. The experience also drove home the importance of aligning the Courts’ expectations for digital projects, and of our internal capacity to manage and realize increasingly strategic and indispensable digital projects.

Along with CAS’s regular maintenance of existing systems, we began implementing a foundational reset to expand our internal digital capacity, work with the Courts to better align expectations, and incrementally deliver better digital tools and practices to improve court operations, including:

- E-stamping – enabling an electronic mechanism to stamp all court documents thereby further reducing the reliance on paper, including for the TCC’s Appeals System Plus CASe management system.

- E-courtrooms – upgrading courtrooms so that they are equipped to handle digital hearings; CAS now has 16 e-courtrooms, 6 of which were established in the 2022–23 fiscal year.

- E-filing – making certain court documents available to the public, increasing the availability of information. Notably, significant work concluded in preparation for the planned launch of the FCA e-filing solution in the summer of 2023.

- Law Clerk Applicant System – delivered a modern end-to-end system for law student applications for a Law Clerk position with our Courts and streamlining the selection process.

- TCC virtual proceedings – allowing for the public and the Court to participate in virtual hearings, reducing the workload of the Registry.

CAS is investing in, as well as levering, new technologies and emerging trends, not only to improve our services, but also to improve access to justice and meet the expectations of Canadians. Failure to do so would undermine the relevance of the Courts, and ultimately erode trust in the Courts and judicial system. In the coming year, CAS will further investigate emerging technologies, deploy automation to improve court and registry processes, and pilot the potential for artificial intelligence to add to our translation processes and capabilities.

National courthouses and court facilities — Deliver modern, equipped, accessible and secure federal court facilities across Canada.

In 2022–23, CAS secured significant investments and set out a multi-year plan, referred to as the National Courts Facilities Modernization Program (NCFMP), to address medium to long-term requirements for modern, equipped, accessible and secure courtrooms and court facilities across Canada. These investments will help ensure that our facilities continue to meet users’ needs and expectations and improve access to justice. Notably, the National Judicial Complex in Montréal will be the first court facility dedicated exclusively to the Courts.

The scope of the NCFMP work is considerable and will be staged over 5 years. In 2022–23, we completed the following:

- conceptual design work for the new National Judicial Complex in Montréal

- enabling work in Toronto, including completing the first draft of the functional program, installing a high-density shelving system, studying vertical transportation, and painting public areas in need of a refresh

- pre-implementation planning for projects in Halifax, Ottawa, Southern Ontario, Winnipeg, Saskatoon and Victoria

Throughout the year, many smaller-scale, though necessary, facilities improvements were completed, including:

- refresh of the Fredericton and Vancouver court facilities

- construction of new judicial chambers in Ottawa

Over the course of the year, the preventative measures put in place in CAS facilities (public, staff working areas and courtrooms) in response to the pandemic were adjusted and ultimately removed to reflect the evolution of public health guidelines.

In 2022–23, CAS continued to equip more courtrooms with modern technology to improve the service experience of hearings through improved access to digital documents in courtrooms and an improved ability to conduct hearings virtually or in a hybrid format. As stated above, 6 courtrooms were upgraded to e-courtrooms: 3 in Toronto, 1 in Ottawa, 1 in Vancouver and 1 in Calgary. CAS also increased the use of service-design practices to ensure that technology investments truly improved the courtroom experience, for both members of the Courts and litigants.

Workforce of the future — Attract, retain and develop a highly- skilled, diverse and engaged workforce. Optimize our work environment and strengthen management excellence.

CAS’s ability to provide services to the Courts and Canadians is an expression of the strength of its workforce. Much of the work undertaken at CAS requires specialized skills and knowledge, and success necessitates high-achieving employees who are both agile and innovative, as well as diversity across our ranks. Consequently, both employee training and retention have emerged as key challenges to maintaining our high standard of service post-pandemic.

In this context, in 2022–23, CAS undertook initiatives to ensure it had the right people in place with the right skills to meet the Courts’ needs. By prioritizing progress in the areas of accessibility, diversity, equity, inclusion, recruitment, wellbeing and mental health, CAS is building a workforce that represents the public we serve, and that has the skills, expertise, experience, and support to meet the evolving needs of the Courts, Canadians and the public service. Highlights for the fiscal year 2022–23 included:

- Streamlining staffing processes to gain efficiencies, for example, establishing collective hiring processes to create perpetual pools, as well as standing inventories for difficult to staff positions.

- Emphasizing both mental health and a psychologically-healthy and safe environment, particularly through the leadership of the Mental Health Champion and specialized training sessions on topics such as self-care, resilience and coping with stress.

- Focusing the efforts of CAS’s Diversity, Inclusion and Anti-Racism Committee on establishing gender-neutral washrooms, renewing art installations within CAS facilities, and reviewing internal documentation such as policy instruments, plans, and tools. CAS also approved its Diversity and Inclusion Strategic Plan for 2022–25, which includes actions to eliminate all forms of racism and discrimination, and foster inclusion and a sense of belonging in our workplace. As a result, CAS has made significant strides in diversity, inclusion and equity, which respond to the Clerk of the Privy Council’s Call to Action on Anti-Racism, Equity, and Inclusion in the Federal Public Service Footnote iii.

- Launching a change management strategy to build lasting organizational capacity to navigate and adapt to change. Workshops on emotional intelligence and on thriving through transitions were offered to all employees, and advisory services were made available for change initiatives and projects. Ultimately, CAS advanced the transition from a mindset of “how we do things now” to “how we will do things in the future.”

- Introducing a new Innovation Champion to identify, celebrate and ultimately further drive innovation within CAS.

Service excellence – Provide consistent, quality and timely client-centric services. Modernize our practices, processes and tools and integrate new business and technological solutions.

CAS’s guiding principle remains service excellence. By adopting a service-oriented mindset, applying service design principles, and placing justice system users at the center of what we do, CAS is improving how we deliver high-quality, modern, secure, accessible and reliable services to improve Canadians’ access to and experience with the justice system.

In 2022–23, CAS continued to focus on driving a cultural shift towards service excellence. Initiatives for the past fiscal year included:

- Conducting a service review of immigration registry services and identifying opportunities to enhance and reimagine service delivery over the coming years, including development of “journey maps” outlining the end-to-end experience from a user’s perspective to identify and eliminate pain points in the system.

- Establishing a new data science team and developing a preliminary data strategy to unlock the value of data as a strategic asset, including to continuously inform and improve service delivery. By investing in obtaining quality data, gathering client insights, understanding user experiences, and measuring and improving service satisfaction, CAS will be able to improve how we work and make decisions, and thereby deliver better judicial and registry services.

- Reinvigorating strategic planning, risk management and governance with the aim of stabilizing and re-establishing more regular court operations. Notably, CAS improved workload distribution within and across regions and consolidated and integrated information management practices.

Providing our court decisions in both official languages continues to be a challenge that will increase in the coming years. Amendments to the Official Languages Act will come into force in June 2024, requiring CAS to release decisions in both official languages simultaneously when they are of precedential value. The impact on CAS’s operations will be very significant and resource intensive.

In 2022–23, in preparation for the implementation of the new requirements, CAS reviewed internal translation processes, negotiated augmented capacity from the Translation Bureau, secured new contracts with private-sector translation services, established agreements with graduate programs in legal translation, improved capacity, refined a costing model for the anticipated increase in volume, and worked with Government of Canada colleagues to identify approaches to funding. Nonetheless, expanded obligations without commensurate funding creates a very real possibility that we will be unable to comply. Recognizing the importance of our official language obligations, CAS will prioritize securing appropriate funding to ensure Canadians are able to access court decisions in the official language of their choice, as part of our commitment to access to justice.

United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

Consistent with the Government of Canada’s priority to reduce negative impacts on the environment and fight climate change, which is in line with the United Nations’ Sustainable Development Goal 13, CAS committed to working with Public Services and Procurement Canada to ensure that all construction projects for the Courts achieve a LEED Gold environmental certification.

CAS will also transform its light-duty fleet to meet Canada’s Greening Government objective of net zero emission vehicles.

Key risks

CAS operates in a complex, changing environment, characterized by a wide array of dependencies and interdependencies. In this context, CAS is exposed to a range of potential risks that, should they materialize, would make it more difficult to realize its planned results and outcomes.

In 2022–23, CAS launched a comprehensive process to identify most significant exposures, as well as their causes, potential impacts and current and future mitigation measures.

The key corporate risks are:

- the organization will not be able to attract, develop and retain an agile workforce with the skills needed to meet the evolving business practices and needs of CAS and the Courts

- legislative, functional and governance frameworks will prevent the organization from delivering its mandate

- organizational funding is inadequate to meet legislative requirements

- organizational capacity and resources will not allow the organization to keep up with the evolving expectations of its employees, Canadians and the Courts

- the organization will not meet the security and privacy expectations of members of the Courts, court users, and employees

- the organization will not be able to maintain an acceptable level of service in the event of disruption

- authoritative information to support decision making will not be available

In 2023–24, CAS will launch a corporate-wide program of active risk management. Not only will this ensure that key exposures are well-managed and results achieved, but it will also allow CAS to better understand which calculated risks should be accepted and still promote advancements, innovation and transformation. Risk management and strategic planning go hand in hand, and establishing a risk profile supports decision making and allocation of limited resources to the appropriate risks.

Results achieved

The following table shows, for administration services for the federal Courts, the results achieved, the performance indicators, the targets and the target dates for 2022–23, and the actual results for the 3 most recent fiscal years for which actual results are available.

| Departmental results | Performance indicators | Targets | Date to achieve targets |

2020–21 actual results |

2021–22 actual results |

2022–23 actual results |

|---|---|---|---|---|---|---|

| Members of the courts are provided with the required information and support services to hear matters and render decisions. | Percentage of court files that are complete and processed accurately. | Exactly 100% | March 31, 2023 | 94%* | 96%* | 95% |

| Members of the courts, court users and the public can access court services, court decisions and processes electronically without undue delays. | Percentage of final court decisions posted on the courts’ websites in both official languages, within established timeframes. | At least 95% | March 31, 2023 | 80% | 97% | 90% |

| Percentage of court documents that are filed electronically. | At least 80% | March 31, 2023 | 54% | 73% | 82% | |

| The courts maintain their ability, as the government’s independent judicial branch, to protect judicial independence | Level of satisfaction of the members of the courts with the adequacy of services provided to discharge their judicial functions. | At least a rating of 4 on a scale of 1–5 | March 31, 2023 | Not evaluatedΩ | Not evaluatedΩ | Not evaluatedΩ |

|

* Represents the average for the FCA and the FC. Results are not included for the CMAC as the sample size is too small to be statistically significant. The TCC does not track performance data for this indicator. |

||||||

|

Ω Measurement of these results has been deferred. |

||||||

Financial, human resources and performance information for CAS’s program inventory is available in GC InfoBase. Footnote iv

Budgetary financial resources (dollars)

The following table shows, for administration services for the federal Courts, budgetary spending for 2022–23, as well as actual spending for that year.

| 2022–23 Main Estimates | 2022–23 planned spending | 2022–23 total authorities available for use | 2022–23 actual spending (authorities used) | 2022–23 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| 71,838,699 | 73,105,426 | 78,017,013 | 73,044,929 | (60,497) |

Financial, human resources and performance information for CAS’s program inventory is available in GC InfoBase. Footnote v

Human resources (full-time equivalents)

The following table shows, in full time equivalents, the human resources the department needed to fulfill this core responsibility for 2022–23.

| 2022–23 planned full-time equivalents |

2022–23 actual full-time equivalents |

2022–23 difference (actual full-time equivalents minus planned full-time equivalents) |

|---|---|---|

| 578 | 575 | (3) |

Financial, human resources and performance information for CAS’s program inventory is available in GC InfoBase.Footnote vi

Internal services

Description

Internal services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal services refers to the activities and resources of the 10 distinct service categories that support program delivery in the organization, regardless of the internal services delivery model in a department. The 10 service categories are:

- acquisition management services

- communication services

- financial management services

- human resources management services

- information management services

- information technology services

- legal services

- material management services

- management and oversight services

- real property management services

Contracts awarded to Indigenous businesses

CAS is a Phase 3 organization and is aiming to achieve the minimum 5% target by the end of 2024–25. Nevertheless, CAS has been meeting the 5% target for the past 3 years with procurement practices currently in place. CAS is working on additional initiatives with its largest business owners to create additional opportunities for Indigenous businesses, and is updating internal policies to create more awareness and opportunities with indigenous businesses.

All of the current procurement employees have completed the mandatory course, Indigenous Considerations in Procurement (COR409) from the Canada School of Public Service.

Budgetary financial resources (dollars)

The following table shows, for internal services, budgetary spending for 2022–23, as well as spending for that year.

| 2022–23 Main Estimates |

2022–23 planned spending |

2022–23 total authorities available for use |

2022–23 actual spending (authorities used) |

2022–23 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| 27,468,293 | 26,201,566 | 34,536,001 | 35,009,732 | 8,808,166 |

Human resources (full-time equivalents)

The following table shows, in full time equivalents, the human resources the department needed to carry out its internal services for 2022–23.

| 2022–23 planned full-time equivalents |

2022–23 actual full-time equivalents |

2022–23 difference (actual full-time equivalents minus planned full-time equivalents) |

|---|---|---|

| 183 | 217 | 34 |

Spending and Human Resources

Spending

Spending 2020–21 to 2025–26

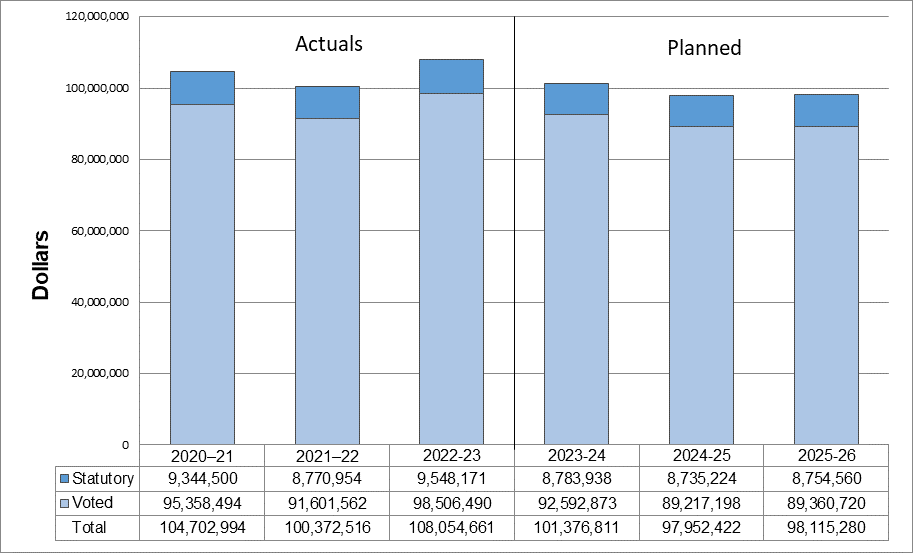

The following graph presents planned (voted and statutory) spending over time.

Description of the image

Departmental Spending Trend

This bar graph shows the Courts Administration Service’s total actual and planned expenditures, including statutory and voted spending, from 2020–21 to 2025–26.

- In 2209–21, voted spending was $95.3 million and statutory spending was $9.3 million. Total spending was $104.7 million.

- In 2021–22, voted spending was $91.6 million and statutory spending was $8.7 million. Total spending was $100.3 million.

- In 2022–23, voted spending of $98.5 million and statutory spending of $9.5 million are planned. Total spending is $108 million.

- In 2023–24, voted spending of $92.5 million and statutory spending of $8.7 million are planned. Total planned spending is $101.3 million.

- In 2024–25, voted spending of $89.2 million and statutory spending of $8.7 million are planned. Total planned spending is $97.9 million.

- In 2025–26, voted spending of $89.3 million and statutory spending of $8.7 million are planned. Total planned spending is $98. million.

Notes

The increase in actual spending in 2022–23 compared to 2021–22 is primarily due to the new funding received to support additional judicial positions, and funding for capacity building to support the modernisation of courtrooms infrastructures.

Fiscal years 2020–21 through 2022–23 included other salary-related payments for existing employee benefits such as severance and maternity pay, the option offered to employees to convert severance pay entitlements into cash, and lump sum payments for collective agreements, which fluctuate year to year and are not included in planned spending figures for 2023–24 to 2025–26.

Budgetary performance summary for core responsibility and internal services (dollars)

The “Budgetary performance summary for core responsibility and internal services” table presents the budgetary financial resources allocated for CAS’s core responsibility and for internal services.

| Core Responsibilities and Internal Services | 2022–23 Main Estimates | 2022–23 Planned spending | 2023–24 Planned spending | 2024–25 Planned spending | 2022–23 Total authorities available for use | 2020–21 Actual spending (authorities used) | 2021–22 Actual spending (authorities used) | 2022–23 Actual spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Administration services for the federal Courts | 71,838,699 | 73,105,426 | 66,453,223 | 66,479,452 | 78,017,013 | 75,571,641 | 67,891,005 | 73,044,929 |

| Subtotal | 71,838,699 | 73,105,426 | 66,453,223 | 66,479,452 | 78,017,013 | 75,571,641 | 67,891,005 | 73,044,929 |

| Internal Services | 27,468,293 | 26,201,566 | 27,142,866 | 27,153,579 | 34,536,001 | 29,131,353 | 32,481,511 | 35,009,732 |

| Total | 99,306,992 | 99,306,992 | 93,596,089 | 93,633,031 | 112,553,014 | 104,702,994 | 100,372,516 | 108,054,661 |

Note:

The total authorities available for use in 2022–23 were $13.2 million higher than 2022–23 planned spending. This is due to new funding received in Budget 2022 for Additional Judicial Resources and to support the Government Response to the Report of the 2020 Quadrennial Commission of $2.7 million, an operating budget carry forward from 2021–22 for $4.0 million, a reprofile from 2021–22 to 2022–23 for COVID funding $4.0 million and CRMS $0.4 million, paylist-related items for $0.6 million, compensation for collective bargaining agreements for $0.8 million and an adjustment to statutory authority of $0.7 million.

The variance between 2022–23 actual spending is the lapse that occurred due to a combination of factors, mainly delays in project delivery and timing of expenditures.

Human resources

The “Human resources summary for core responsibility and internal services” table presents the full-time equivalents (FTEs) allocated to each of CAS’s core responsibility and to internal services.

| Core responsibilities and internal services | 2020–21 actual full-time equivalents |

2021–22 actual full-time equivalents |

2022–23 planned full-time equivalents |

2022–23 actual full-time equivalents |

2023–24 planned full-time equivalents |

2024–25 planned full-time equivalents |

|---|---|---|---|---|---|---|

| Administration services for the federal Courts | 568 | 562 | 578 | 575 | 561 | 546 |

| Subtotal | 568 | 562 | 578 | 575 | 561 | 546 |

| Internal Services | 185 | 193 | 183 | 217 | 183 | 183 |

| Total | 753 | 755 | 761 | 792 | 744 | 729 |

Note

The variance in the actuals full-time equivalents (FTE’s) in 2022–23 compared to the planned FTEs demonstrate a net increase of 31 FTEs. There is an increase of 6 FTEs related to COVID positions that were not included in the 2022–23 departmental plan. Furthermore, 8 FTEs were added to invest in temporary change management resources required to deliver transformation of Court processes and technologies, and invest in policy analysis and governance capacity to strengthen the delivery of Court business cases. Additionally, 7 FTEs were added in IT positions to align with the Court transformation priorities, and another 6 FTEs were added to support facilities infrastructures projects and treasury board submissions. The remaining increase of 4 FTEs is due to timing difference in the hiring processes and new management positions created.

Planned FTE’s in 2023–24 and future years are lower because of sunsetting funding and does not account for new incoming funding that was not already received at the time of the 2022–23 Departmental Plan.

Expenditures by vote

For information on CAS’s organizational voted and statutory expenditures, consult the Public Accounts of Canada. Footnote vii

Government of Canada spending and activities

Information on the alignment of CAS’s spending with Government of Canada’s spending and activities is available in GC InfoBase. Footnote viii

Financial statements and financial statements highlights

Financial statements

CAS’s financial statements (unaudited) for the year ended March 31, 2023, are available on the department’s website.

Financial statements highlights

| Financial information | 2022–23 Planned results | 2022–23 Actual results | 2021–22 Actual results | Difference (2022–23 Actual results minus 2022–23 Planned results) | Difference (2022–23 Actual results minus 2021–22 Actual results) |

|---|---|---|---|---|---|

| Total expenses | 131,122,575 | 145,940,614 | 130,920,683 | 14,818,039 | 15,019,931 |

| Total revenues | 0 | 159 | 307 | 159 | (148) |

| Net cost of operations before government funding and transfers | 131,122,575 | 145,940,773 | 130,920,990 | 14,818,198 | 15,019,783 |

Note

The 2022–23 planned results are those reported in the Future-Oriented Statement of Operations Footnote ix included in the 2022–23 Departmental Plan.

Expenses: CAS’s total expenses were $145,9 million in 2022–23 ($130,9 million in 2021–22). The increase of $15,0 million (11.47%) is mainly due to the increase of $8,4 million in salaries and wages, and an increase of $6,6 million in operating expenses.

Salaries and employee benefits: The salaries and employee benefits expense was $82,6 million in 2022–23 ($74,1 million in 2021–22). The $8,4 million (11.34%) variance is due to increases of $7,1 million in salaries and wages, and $792,170 in employer contributions to employee benefit plans, both of which were a direct result of the increase in 37 full time equivalents (FTEs), and retroactive pay resulting from the expired collective agreements as of March 2023. Other variances include: 369,471 in the provision of severance benefits, and an increase of $85,615 in employer contributions to the health and dental insurance plans (related party transaction). More than half (56.60%) of CAS’s total expenses in 2022–23 consisted of salaries and employee benefits.

Operating: Operating expenses totalled $63,3 million in 2022–23 ($56,7 million in 2021–22). The $6,6 million (11.65%) variance is mainly attributable to increases of $2,7 million in professional and special services, $1,1 million in amortization of tangible capital assets, $988,957 in accommodation, $792,199 in transportation and telecommunications, $627,392 in rentals, $505,583 in miscellaneous expenditures, $307,895 in repairs and maintenance, and $143,667 in machinery and equipment. These increases were partly offset by decreases of $551,356 in materials and supplies, and $49,310 in printing and publishing.

Revenues: The majority of CAS’s revenues are earned on behalf of Government. Such revenues are non-respendable, meaning that they cannot be used by CAS, and are deposited directly into the Consolidated Revenue Fund (CRF). CAS earns a small amount of respendable revenue from the sale of Crown assets. CAS’s gross revenues were $3,4 million in 2022–23 ($2,4 million in 2021–22) and its net revenues were $159 in 2022–23 ($307 in 2021–22).

| Financial information | 2022–23 | 2021–22 | Difference (2022–23 minus 2021–22) |

|---|---|---|---|

| Total net liabilities | 26,492,419 | 24,370,814 | 2,121,605 |

| Total net financial assets | 16,580,852 | 19,847,492 | (3,266,640) |

| Departmental net debt | 9,911,567 | 4,523,322 | 5,388,245 |

| Total non-financial assets | 28,423,627 | 29,164,849 | (741,222) |

| Departmental net financial position | 18,512,060 | 24,641,527 | (6,129,467) |

The 2022–23 planned results information is provided in CAS’s Future-Oriented Statement of OperationsFootnote x and Notes 2022–23.

Note:

Total liabilities: CAS’s net liabilities as at March 31, 2023 were $26,5 million ($24,4 million as at March 31, 2022). The increase of $2,1 million (8.71%) is the result of the following:

Accounts payable and accrued liabilities (54.40% of total liabilities): Increase of $3,0 million composed of an increase of $1,4 million in accounts payable to other government departments and agencies and of $3,0 million in accrued liabilities related to salaries and wages. The increase is offset by a decrease of $1,3 million in accounts payable to external parties.

Deposit accounts (22.98% of total liabilities): The decrease of $923,748 in deposit accounts reflects many separate decisions of the Courts. Deposits cannot be projected and the balance in the deposit accounts can vary significantly from year to year.

Vacation pay and compensatory leave (17.16% of total liabilities): Increase of $131,701 includes an increase of $175,606 in vacation pay allowance, partly offset by a decrease of $43,905 in compensatory leave allowance.

Employee future benefits (5.46% of total liabilities): The decrease of $140,210 is due to a decrease in the severance benefit liability.

Assets: The composition of CAS’s financial and non-financial assets is as follows:

Financial assets:

- Due from the CRF (32.72% of gross assets)

- Accounts receivable and advances (6.54% of gross assets)

Non-financial assets:

- Tangible capital assets (54.87% of gross assets)

- Prepaid expenses (4.35% of gross assets)

- Inventory (1.52% of gross assets)

Total net financial assets: This is comprised of financial assets net of accounts receivable held on behalf of Government. Accounts receivable held on behalf of the Government of Canada consist primarily of accounts receivable from other governmental organizations. The decrease of $3,3 million is due to a decrease in the accounts receivable and advances and amount due from the CRF as well as an increase in accounts receivable and advances held on behalf of the Government.

Total non-financial assets: The decrease of $741,222 is mainly due to a decrease of $1,7 million in tangible capital assets related to facilities renovation projects, and installation of informatics equipment. This decrease is partly offset by an increase of $959,669 in prepaid expenses and $29,169 in inventory.

Departmental net debt: This provides a measure of the future authorities required to pay for past transactions and events.

Departmental net financial position: This represents the net resources (financial and non-financial) that will be used to provide future services to the Courts and thereby to benefit Canadians.

Corporate information

Organizational profile

Appropriate minister: The Honourable Arif Virani, P.C., P.C., M.P.

Institutional head: Darlene H. Carreau, Chief Administrator and Chief Executive Officer

Ministerial portfolio: Justice

Enabling instrument(s): Courts Administration Service Act, S.C. 2002, c. 8Footnote xii

Year of incorporation / commencement: 2003

Raison d’être, mandate and role: who we are and what we do

“Raison d’être, mandate and role: who we are and what we do” is available on CAS's website Footnote xi.

For more information on the department’s organizational mandate letter commitments, see the Minister’s mandate letterFootnote xiii.

Operating context

Information on the operating context is available on CAS’s websiteFootnote xiv.

Reporting framework

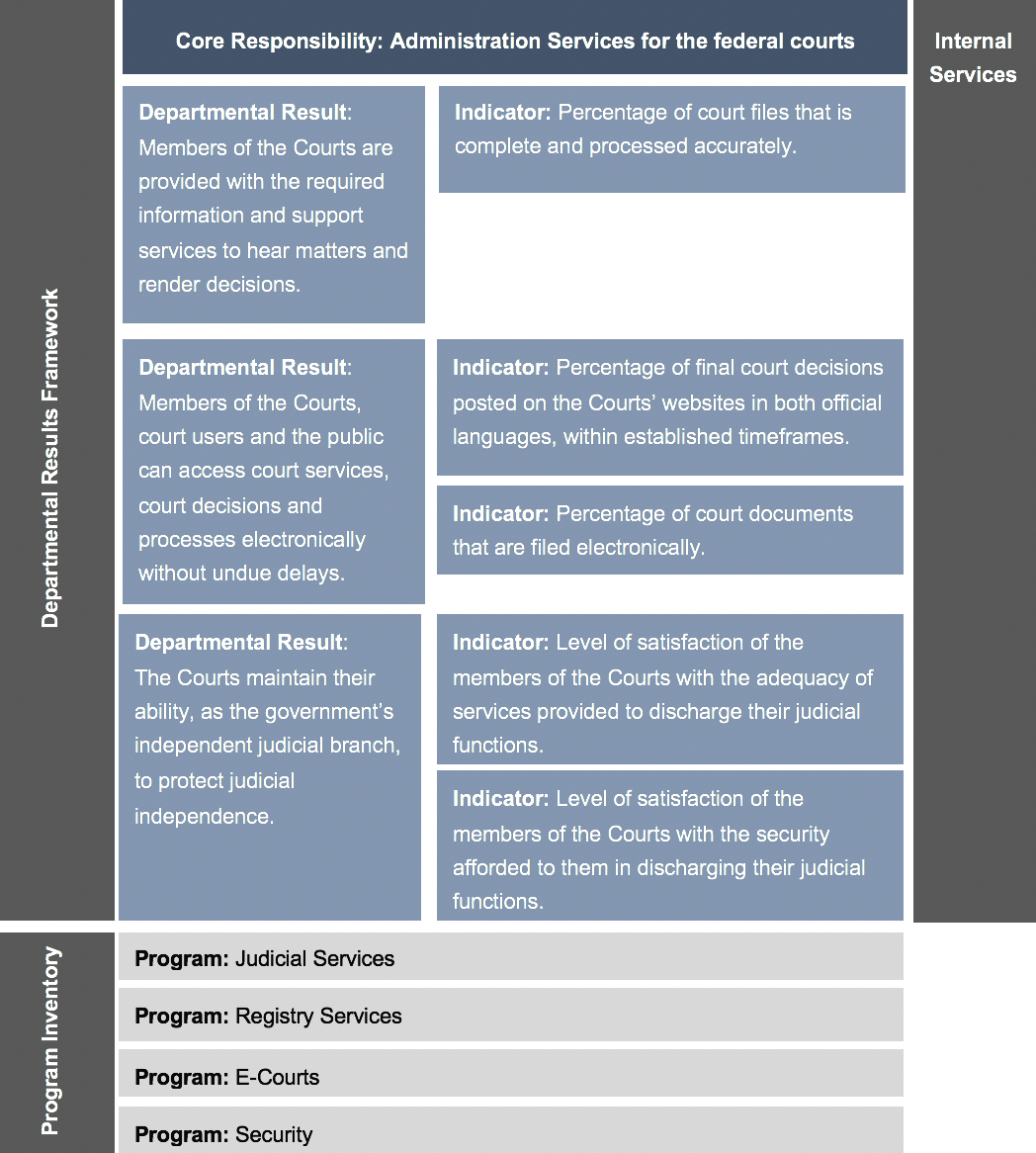

CAS’s departmental results framework and program inventory of record for 2022–23 are shown below.

Description of the image

Departmental Results Framework

Departmental Result: Members of the Courts are provided with the required information and support services to hear matters and render decisions.

Indicator: Percentage of court files that are complete and processed accurately.

Departmental Result: Members of the Courts, court users and the public can access court services, court decisions and processes electronically without undue delays.

Indicator: Percentage of final court decisions posted on the Courts’ websites in both official languages, within established timeframes.

Indicator: Percentage of court documents that are filed electronically.

Departmental Result:

The Courts maintain their ability, as the government’s independent judicial branch, to protect judicial independence.

Indicator: Level of satisfaction of the members of the Courts with the adequacy of services provided to discharge their judicial functions.

Indicator: Level of satisfaction of the members of the Courts with the security afforded to them in discharging their judicial functions.

Internal Services

Program Inventory

Program: Judicial Services

Program: Registry Services

Program: E-Courts

Program: Security

Supporting information on the Program Inventory

Financial, human resources and performance information for CAS’s program inventory is available in GC InfoBase. Footnote xv

Supplementary information tables

The following supplementary information tables are available on CAS’s website:

- Reporting on Green Procurement

- Gender-based analysis plus

- United Nations 2030 Agenda and the Sustainable Development Goals

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures. Footnote xvi This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs as well as evaluations and GBA Plus of tax expenditures.

Organizational contact information

Mailing address:

Courts Administration Service

90 Sparks Street

Thomas D’Arcy McGee Building

Ottawa, Ontario K1A 0H9

Telephone: (613) 943-4355 (media inquiries)

Email: Info@cas-satj.gc.ca

Website: http://www.cas-satj.gc.ca

Appendix: definitions

- appropriation (crédit)

- Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

- Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- core responsibility (responsabilité essentielle)

- An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

- A report on the plans and expected performance of an appropriated department over a 3 year period. Departmental Plans are usually tabled in Parliament each spring.

- departmental priority (priorité)

- A plan or project that a department has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired departmental results.

- departmental result (résultat ministériel)

- A consequence or outcome that a department seeks to achieve. A departmental result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

- departmental result indicator (indicateur de résultat ministériel)

- A quantitative measure of progress on a departmental result.

- departmental results framework (cadre ministériel des résultats)

- A framework that connects the department’s core responsibility to its departmental results and departmental result indicators.

- Departmental Results Report (rapport sur les résultats ministériels)

- A report on a department’s actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

- full time equivalent (équivalent temps plein)

- A measure of the extent to which an employee represents a full person year charge against a departmental budget. For a particular position, the full time equivalent figure is the ratio of number of hours the person actually works divided by the standard number of hours set out in the person’s collective agreement.

- gender-based analysis plus (GBA Plus) (analyse comparative entre les sexes plus [ACS Plus])

- An analytical tool used to support the development of responsive and inclusive policies, programs and other initiatives; and understand how factors such as sex, race, national and ethnic origin, Indigenous origin or identity, age, sexual orientation, socio-economic conditions, geography, culture and disability, impact experiences and outcomes, and can affect access to and experience of government programs.

- government-wide priorities (priorités pangouvernementales)

- For the purpose of the 2022–23 Departmental Results Report, government-wide priorities are the high-level themes outlining the government’s agenda in the November 23, 2021, Speech from the Throne: building a healthier today and tomorrow; growing a more resilient economy; bolder climate action; fighter harder for safer communities; standing up for diversity and inclusion; moving faster on the path to reconciliation; and fighting for a secure, just and equitable world.

- horizontal initiative (initiative horizontale)

- An initiative where two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

- non-budgetary expenditures (dépenses non budgétaires)

- Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- performance (rendement)

- What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- performance indicator (indicateur de rendement)

- A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

- performance reporting (production de rapports sur le rendement)

- The process of communicating evidence based performance information. Performance reporting supports decision making, accountability and transparency.

- plan (plan)

- The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead to the expected result.

- planned spending (dépenses prévues)

-

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports. - program (programme)

- Individual or groups of services, activities or combinations thereof that are managed together within the department and focus on a specific set of outputs, outcomes or service levels.

- program inventory (répertoire des programmes)

- Identifies all the department’s programs and describes how resources are organized to contribute to the department’s core responsibilities and results.

- result (résultat)

- A consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization’s influence.

- Indigenous business (enterprise autochtones)

- For the purpose of the Directive on the Management of Procurement Appendix E: Mandatory Procedures for Contracts Awarded to Indigenous Businesses and the Government of Canada’s commitment that a mandatory minimum target of 5% of the total value of contracts is awarded to Indigenous businesses, an organization that meets the definition and requirements as defined by the Indigenous Business Directory.

- statutory expenditures (dépenses législatives)

- Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

- target (cible)

- A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

- voted expenditures (dépenses votées)

- Expenditures that Parliament approves annually through an appropriation act. The vote wording becomes the governing conditions under which these expenditures may be made.

- Date modified: