Financial Statements Discussion and Analysis

2022-23

Introduction

This Financial Statements Discussion and Analysis (FSD&A) should be read in conjunction with the Financial Statements of the Courts Administration Service (CAS) for the fiscal year ended March 31, 2023. These Financial Statements were prepared using the Government's accounting policies, which are based on Canadian public sector accounting standards. The FSD&A has been prepared following the Public Sector Statement of Recommended Practice (SORP-1).

Responsibility for the preparation of the FSD&A rests with the management of CAS. The purpose of the FSD&A is to enhance the user’s understanding of the organization’s financial position and results of operations, while demonstrating its accountability for its resources. Additional information on the organization’s performance is available in the Departmental Results Report.

The FSD&A consist of three sections:

Please note that all financial information presented herein is denominated in Canadian dollars, unless otherwise indicated.

Special note regarding forward-looking statements

The words “estimate”, “will”, “intend”, “should”, and similar expressions are intended to identify forward-looking statements that reflect assumptions and expectations of the organization, based on its experience and perceptions of trends and current conditions. Although CAS believes the expectations reflected in such forward-looking statements are reasonable, they may prove to be inaccurate; consequently, actual results could differ materially from expectations set out in this FSD&A. In particular, the risk factors described in this report could cause actual results or events to differ materially from those contemplated in forward-looking statements.

Overview

CAS was established in 2003 by the Courts Administration Service Act, S.C. 2002, c. 8. CAS’s role is to provide effective and efficient judicial, registry, e-courts, court security and internal services to the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada (“the Courts”). The Chief Administrator of CAS serves as Deputy Head.

CAS was created to ensure the effective and efficient provision of administrative, judicial and registry support to the four superior courts of record; to enhance judicial independence by placing administrative services at arm’s length from the Government of Canada and affirming the roles of the chief justices and judges in the management of the Courts; and to enhance accountability for the use of public money in support of court administration while safeguarding the independence of the judiciary. This ensures timely and fair access to the judicial system, which is essential to constitutional governance.

CAS’s budget is allocated through authorities approved by Parliament. CAS has one voted authority for program expenditures and statutory authorities for contributions to employee benefit plans, spending of proceeds from the disposal of surplus Crown assets, and refunds of amounts credited to revenues in previous years.

Since authorities are primarily based on cash flow requirements, authorities provided to CAS do not parallel financial reporting according to generally accepted accounting principles. Consequently, items recognized in the Statement of Financial Position and the Statement of Operations and Departmental Net Financial Position are not necessarily the same as those provided through authorities from Parliament. Note 3 of the Financial Statements provides a reconciliation between the bases of reporting.

The Financial Statements of CAS have not been audited. A Statement of Management Responsibility, including Internal Control over Financial Reporting (ICFR), is provided by Management as part of the annual departmental financial statement publication.

Special note regarding COVID-19

The outbreak of the COVID-19 pandemic has resulted in governments worldwide enacting emergency measures to combat the spread of the virus. These measures, which include the implementation of travel bans, self-imposed quarantine periods and social distancing, have caused material disruption to businesses globally resulting in an economic slowdown. Whilst the COVID-19 pandemic was no longer a threat by the end of the 2022-23 fiscal year, there could still be a residual impact on CAS’ financial position since its return to normal operating status.

Highlights

Parliamentary Authorities

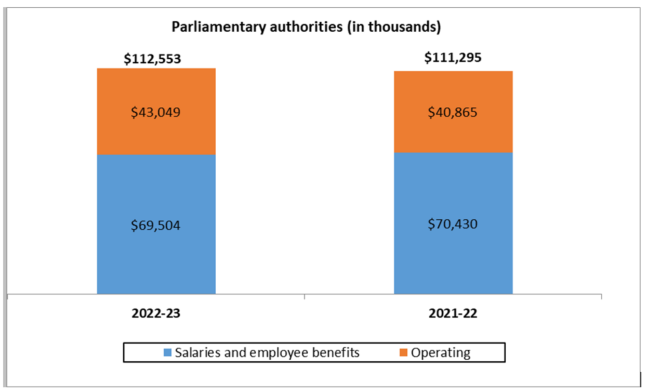

The parliamentary authorities available for use by CAS include funding received through the Main Estimates, Supplementary Estimates, Supplementary Estimates, Transfers, Adjustments and Warrants. These authorities increased by $1,258 thousand, from $111,295 thousand in 2021-22 to $112,553 thousand in 2022-23. This variance is the result of several factors, as outlined below.

Description of the image

Parliamentary authorities

In 2022-23: Salaries and employee benefits authorities were $69,504 thousand. Operating authorities were $43,049 thousand. Total authorities were $112,553 thousand.

In 2021-22: Salaries and employee benefits authorities were $70,430 thousand. Operating authorities were $40,865 thousand. Total authorities were $111,295 thousand.

The increase in authorities is due to the following items: $1,800 thousand from the Toronto expansion project 2021-22 reprofile, $1,585 increase in funding to enhance the capacity of superior courts, $1,322 thousand increase in the operating budget carry forward, $962 thousand increase in funding to support the delivery of justice for facilities related projects, $792 thousand increase in contributions to employee benefit plans, and $295 thousand increase in compensation for collective bargaining. The remaining $168 thousand increase is composed of various other items.

The above increases are offset by funding decreases of $4,017 thousand in programs related to COVID, $1,113 thousand for the Courts and Registry Management System (CRMS), a reduction of $394 thousand in enhancing the integrity of Canada’s borders and asylum system. The remaining reduction of $142 thousand is composed of various other items.

In 2022-23, the total available authorities were $112,553 thousand, of which $108,055 thousand were used in the current year. This resulted in unused authorities creating a gross lapse of $4,498 thousand. This amount was reduced by $1,281 thousand in employee benefit plan (EBP) adjustments, and also included $624 thousand of frozen allotment relating to the Procedural Fairness in citizenship revocation.

The net lapse of $2,593 thousand represents 2.3% of the total available authorities, which is considered to be within normal range.

Financial Highlights

Statement of Financial Position

The Departmental Net Financial Position is the amount remaining when total liabilities are deducted from total assets. CAS’s Departmental Net Financial Position was $18,512 thousand as of March 31, 2023 ($24,641 thousand as of March 31, 2022).

Financial assets: The total net financial assets amounted to $16,581 thousand at March 31, 2023 ($19,847 thousand at March 31, 2022).

Non-financial assets: The total non-financial assets amounted to $28,424 thousand at March 31, 2023 ($29,165 thousand at March 31, 2022).

Significant variations are provided further in the Financial Analysis section.

Statement of Operations and Departmental Net Financial Position

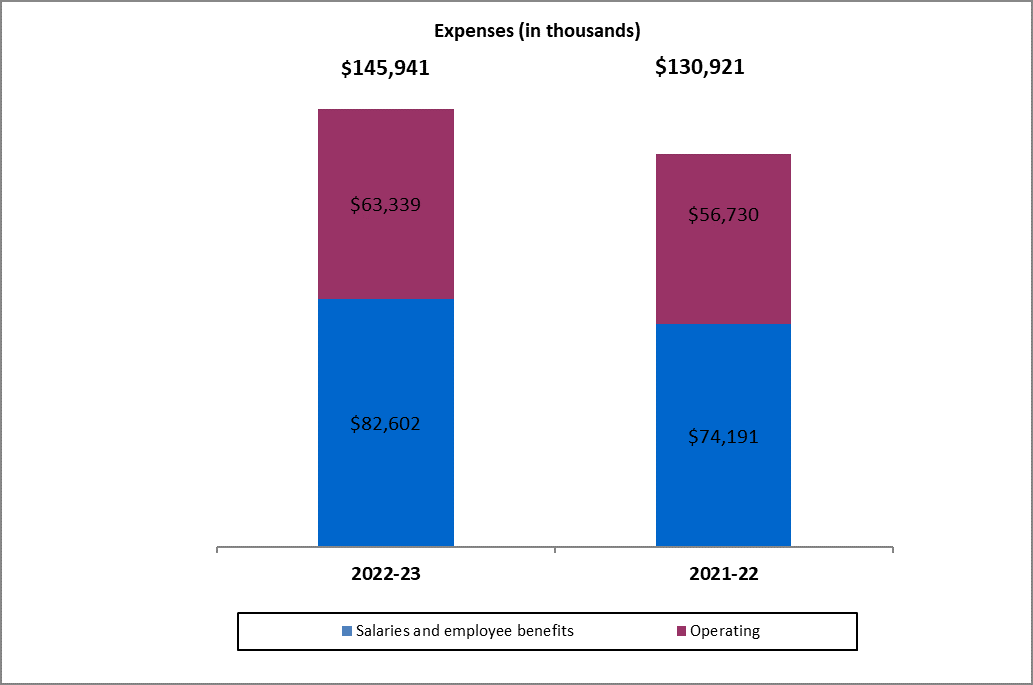

CAS’s net cost of operations before government funding and transfers was $145,941 thousand in 2022-23, an increase of $15,020 thousand (11%) compared to $130,921 thousand in 2021-22. These figures represent the total expenses incurred and revenues earned on behalf of Government. The increase in total expenses is mainly due to increases in employee salaries and benefits, as well as professional and special services and amortization of tangible capital assets, which are explained further in the next section.

Expenses: CAS’s total expenses were $145,941 thousand in 2022-23 ($130,921 thousand in 2020-21).

Salary and employee benefits: Salary and employee benefit expenses amounted to $82,602 thousand ($74,191 thousand in 2021-22), an increase of $8,411 thousand (11%). The increase in personnel expenditures were principally driven by an increase in salaries of $6,316 thousand mainly due to higher salaries and new hiring to support the creation of the new judicial positions. Other increases included $792 thousand in employer contributions to employee benefit plans, $477 thousand in allowance for vacation pay, $376 thousand in overtime pay, $370 thousand in provision for severance benefits, and $85 thousand in employer contribution to the health and dental insurance plans. Various small variances make up the remaining $5 thousand decrease.

Operating: Operating expenses totalled $63,339 thousand ($56,730 thousand in 2021-22). The increase of $6,609 thousand (12%) is mainly attributable to an increase of $2,698 thousand in professional and special services expenses, $1,147 thousand in amortization of tangible capital assets, $989 thousand in accommodation, $792 thousand in transportation and telecommunications, $627 thousand in rentals, $506 thousand in miscellaneous expenses, $307 thousand in repairs and maintenance and $144 thousand in machinery and equipment. These increases were partly offset by a decrease of $551 thousand in materials and supplies, $49 thousand in information services and $1 thousand in expenses incurred on behalf of the Government.

Description of the image

Expenses

In 2022-23: Filing fees revenues were $1,736 thousand. Recovery of administration costs - EI was $1,667 thousand. Fines revenues were $18 thousand. Miscellaneous revenues were $10 thousand.

In 2021-22: Filing fees revenues were $1,502 thousand. Recovery of administration costs - EI was $838 thousand. Fines revenues were $51 thousand. Miscellaneous revenues were $7 thousand.

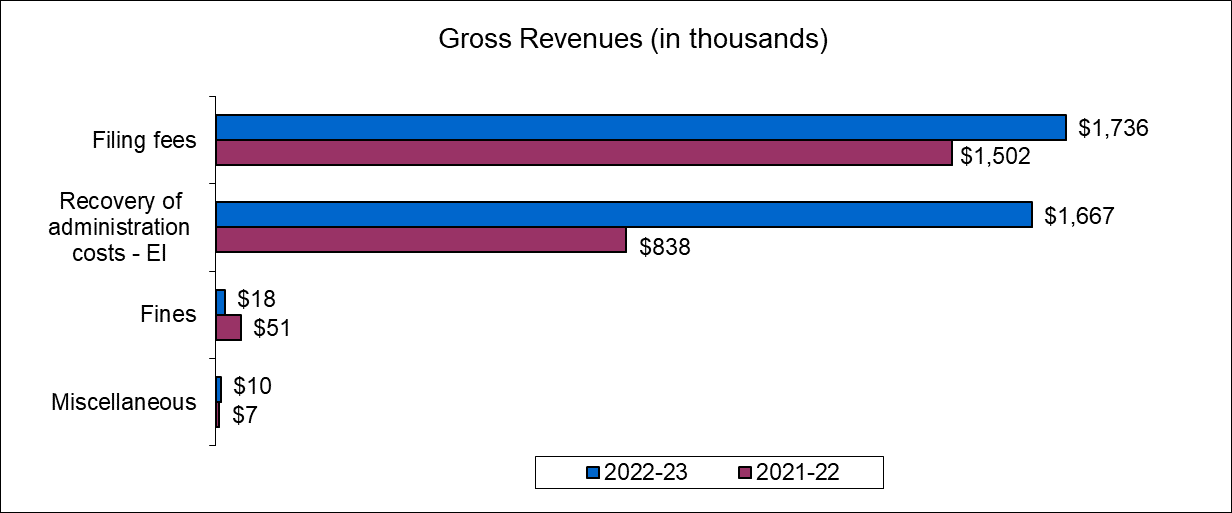

Revenues: The majority of CAS’s revenues are earned on behalf of Government. Such revenues are non-respendable, meaning that they cannot be used by CAS, and are deposited directly into the Consolidated Revenue Fund (CRF). CAS earns a small amount of respendable revenues from the sale of Crown assets. CAS’s gross revenues were $3,431 thousand ($2,398 thousand in 2021-22), and net revenues were $0 thousand ($0 thousand in 2021-22).

Description of the image

Gross Revenues

In 2022-23: Recovery of administration costs – Employment Insurance (EI) was $1,667 thousand. Filing fees, revenues were $1,732 thousand. Fines revenues were $18 thousand. Miscellaneous revenues were $10 thousand. Total gross revenues were $3,431 thousand.

In 2021-22: Recovery of administration costs – Employment Insurance (EI) was $838 thousand. Filing fees revenues were $1,502 thousand. Fines revenues were $51 thousand. Miscellaneous revenues were $7 thousand. Total gross revenues were $2,398 thousand.

Discussion and Analysis

Risks and Uncertainties

Funding

The majority of non-personnel expenses incurred by CAS are contracted costs for services supporting the judicial process, court hearings, court security and e-courts. These costs include translation services, protection services, informatics services, court reporters, transcripts, deputy judges, court ushers and court facility rentals. The volume mostly drives these costs, type and duration of hearings conducted in any given year, which are non-discretionary and can limit the organization's financial flexibility.

The increases in costs, complexity of cases and volume reduce CAS’ ability to invest in critical tools and technology needed. CAS continues to address the risks associated with the lack of financial flexibility by implementing internal mitigation strategies such as: baselining budgets, establishing multi-year budgets, reorganizing and realigning services, reallocating resources as well as reassessing priorities on a regular basis and, exploring alternate funding models, while seeking efficiencies wherever possible. CAS has developed processes which include management participation at the organization’s highest levels. These processes help the organization to identify and evaluate the main risks and allocate resources accordingly to mitigate these risks.

Financial Analysis

The following analysis describes the main items appearing on the financial statements, as well as significant variances.

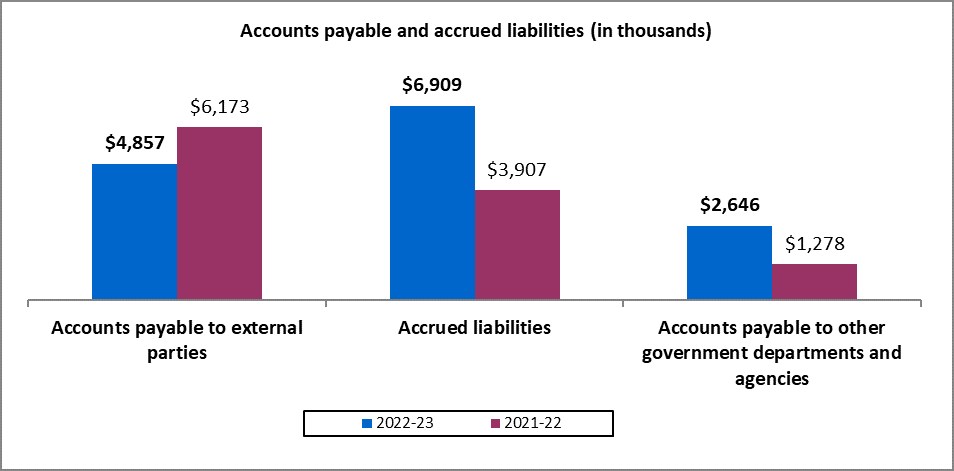

Liabilities

Summary: CAS’s total liabilities were $26,493 thousand as of March 31, 2023 ($24,371 thousand as of March 31, 2022). The variance of $2,122 thousand is an increase in accounts payable and accrued liabilities of $3,054 thousand and $132 thousand in vacation pay and compensatory leave. These increases were partly offset by a decrease of $924 thousand in the deposit account and $140 thousand in employee future benefits.

Accounts payable and accrued liabilities: CAS’s accounts payable and accrued liabilities totalled $14,412 thousand as of March 31, 2023 ($11,358 thousand as of March 31, 2022). The variance of $3,054 thousand is due to an increase of $1,368 in accounts payable to other government departments and agencies, primarily related to common service delivery and $3,002 thousand in accrued liabilities mostly due to the timing of the last pay period of the year (salary accrued) and the timing of the payment of salary increases relating to the signing of collective agreements. The increases were partially offset by a decrease of $1,316 thousand in accounts payable to external parties.

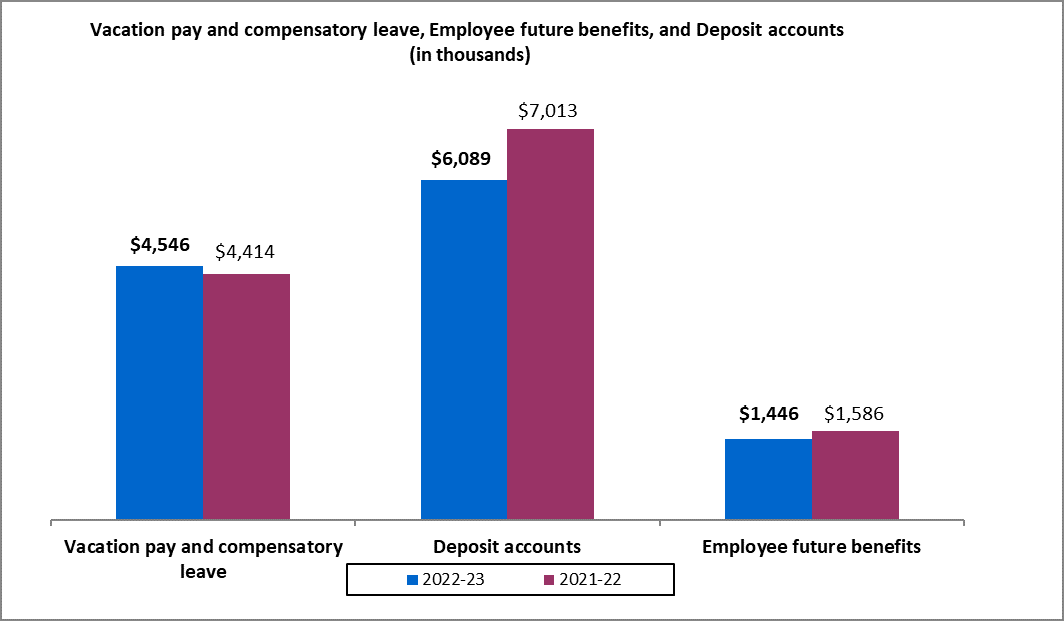

Description of the image

Accounts payable and accrued liabilities

In 2022-23: Accounts payable to external parties were $4,857 thousand. Accrued liabilities were $6,909 thousand. Accounts payable to other government departments and agencies were $2,646 thousand.

In 2021-22: Accounts payable to external parties were $6,173 thousand. Accrued liabilities were $3,907 thousand. Accounts payable to other government departments and agencies were $1,278 thousand.

Vacation pay and compensatory leave: CAS’s vacation pay and compensatory leave year-end balances were $4,546 thousand as of March 31, 2023 ($4,414 thousand as of March 31, 2022). The increase of $132 thousand is the result of an increase in FTE’s partly offset by a decrease in the liability resulting from the decision by Treasury Board Secretariat to lift the moratorium on automatic cash-out of vacation and compensatory leave effective March 31, 2022. As a result of the moratorium lift, the liquidation of 20% per year of excess vacation leave credits is required during this five (5) year transition period. Therefore, employees were encouraged to use their vacation balances in order to avoid the automatic cash-out of excess leave balances.

Deposit accounts: CAS’s deposit accounts amounted to $6,089 thousand as of March 31, 2023 ($7,013 thousand as of March 31, 2022). CAS maintains two Specified Purpose Accounts (SPAs), one for deposits by litigants appearing before the Federal Court of Appeal or the Federal Court, and the other for those appearing before the Tax Court of Canada. These two accounts were established pursuant to Section 21.1 of the Financial Administration Act under Order in Council P.C. 1970 4/2 and Order in Council P.C. 1970-300, respectively. Pursuant to an order of the Court, amounts are held in trust and eventually released with accrued interest. Because payments into or out of the accounts are determined by the Courts, depending on the particular case, the balance is unpredictable and may vary significantly from year to year.

Employee future benefits: CAS’s employee future benefits balance was $1,446 thousand as of March 31, 2023 ($1,586 thousand as at March 31, 2022). The employee future benefits represents the value of the severance benefits earned by employees. The obligation relating to the benefits earned by employees is calculated using information derived from the results of the actuarially determined liability for employee severance benefits for the Government as a whole and is allocated to each department based on a percentage provided by the Treasury Board Secretariat. The $140 thousand decrease in the employee future benefits liability is mainly caused by the severance rate reduction of 0.51% (from 3.31% to 2.80%).

Description of the image

Vacation pay and compensatory leave, Employee future benefits, and Deposit accounts

In 2022-23: Vacation pay and compensatory leave were $4,546 thousand. Deposit accounts were $6,089 thousand. Employee future benefits were $1,446 thousand.

In 2021-22: Vacation pay and compensatory leave were $4,414 thousand. Deposit accounts were $7,013 thousand. Employee future benefits were $1,586 thousand.

Assets

Summary: CAS’s assets are presented as financial assets (amount due from the CRF account, and accounts receivable and advances) and non-financial assets (prepaid expenses, inventory and tangible capital assets).

Financial assets

Total net financial assets: The net financial assets represent the gross financial assets net of the accounts receivable and advances held on behalf of Government. The decrease of $3,266 thousand between the totals reported for net financial assets of $16,581 thousand as of March 31, 2023 and $19,847 thousand as of March 2022 are explained as follows:

- Gross financial assets: The gross financial assets is composed of the due from the Consolidated Revenue Fund and the total accounts receivable and advances. The year-end balance of the gross financial assets was $18,373 thousand as of March 31, 2023 ($20,713 thousand as of March 31, 2022). The variance of $2,340 thousand is due to a decrease of $1,235 thousand in the amount due from the consolidated revenue fund and $1,105 thousand in the total accounts receivable and advances.

- Accounts receivable and advances held on behalf of Government: The accounts receivable for non-respendable revenues in the amount of $1,792 thousand as of March 31, 2023 ($866 thousand as of March 31, 2022) are not available to discharge liabilities and therefore are presented under financial assets held on behalf of Government as a reduction to the gross financial assets. The variance represents an increase of $926 thousand.

Due from the Consolidated Revenue Fund: CAS’s due from the CRF year-end balance was $15,310 thousand as of March 31, 2023 ($16,545 thousand as of March 31, 2022). The decrease of $1,235 is mainly due to a $1,272 thousand decrease in account payable ongoing (net of HST), $924 thousand decrease in deposit accounts and $821 thousand decrease in other Government departments accounts receivable. The decrease was partly offset by an increase of $1,368 thousand in other Government departments’ accounts payable, $304 thousand in accrued salaries and wages, $95 thousand in accrued liabilities and $15 thousand in other loans and advances to employees.

The due from the CRF account represents the net amount of cash that CAS is entitled to withdraw from the CRF in order to discharge its liabilities without generating any additional charges against its authorities in the year of the withdrawal. This includes expenses incurred but not yet paid and amounts received by CAS that will be paid out in future years, offset by accounts receivable from other government departments and agencies.

Accounts receivable and advances: CAS’s accounts receivable and advances balance was $3,063 thousand as of March 31, 2023 ($4,168 thousand as of March 31, 2022). The key components are accounts receivable from other government departments and agencies, and accounts receivable from external parties, offset by the allowance for doubtful accounts.

- Accounts receivable from other government departments and agencies: The year-end balance was $2,407 thousand ($3,495 thousand as of March 31, 2022). The decrease of $1,088 thousand is largely due to a $1,909 thousand decrease in recoverable amounts related to taxes (GST/HST/QST), offset by $821 thousand increase in receivables related to salary recoveries and the Employment Insurance account.

- Accounts receivable from external parties: The year-end balance was $624 thousand ($636 thousand as of March 31, 2022). It includes courtroom fees charged to litigants, as well as employees’ salaries overpayments and other adjustments. The decrease of $12 thousand is mainly due to a decrease of $10 thousand in in other recoveries such as commission of evidence garnishments and O&M recoveries from employees.

- Employee Advances: The year-end balance was $32 thousand ($47 thousand as of March 31, 2022), and is mostly attributable to the issues related to the Phoenix pay system.

- Allowance for doubtful accounts: The year-end balance was nil ($10 thousand as of March 31, 2022). Over the years, CAS has been diligently reviewing and pursuing outstanding accounts receivable.

Financial assets held on behalf of Government: Accounts receivable from non-respendable revenues are presented under financial assets held on behalf of Government in the reduction of the gross financial assets. The year-end balance was $1,792 thousand ($866 thousand as of March 31, 2022). The $926 thousand increase is mainly due to an increase in the accounts receivable from other government departments.

Departmental Net Debt

The Departmental Net Debt (total liabilities less total net financial assets) is an indicator that provides a measure of the future authorities required to pay for past transactions and events. The year-end balance was $9,912 thousand ($4,524 thousand as of March 31, 2022).

Non-financial Assets

Summary: The year-end balance was $28,424 thousand ($29,165 thousand as of March 31, 2022). The decrease of $741 thousand is due to a decrease of $1,730 in tangible capital assets. The non-financial assets are offset by an increase of $960 thousand in prepaid expenses and $29 thousand in inventories.

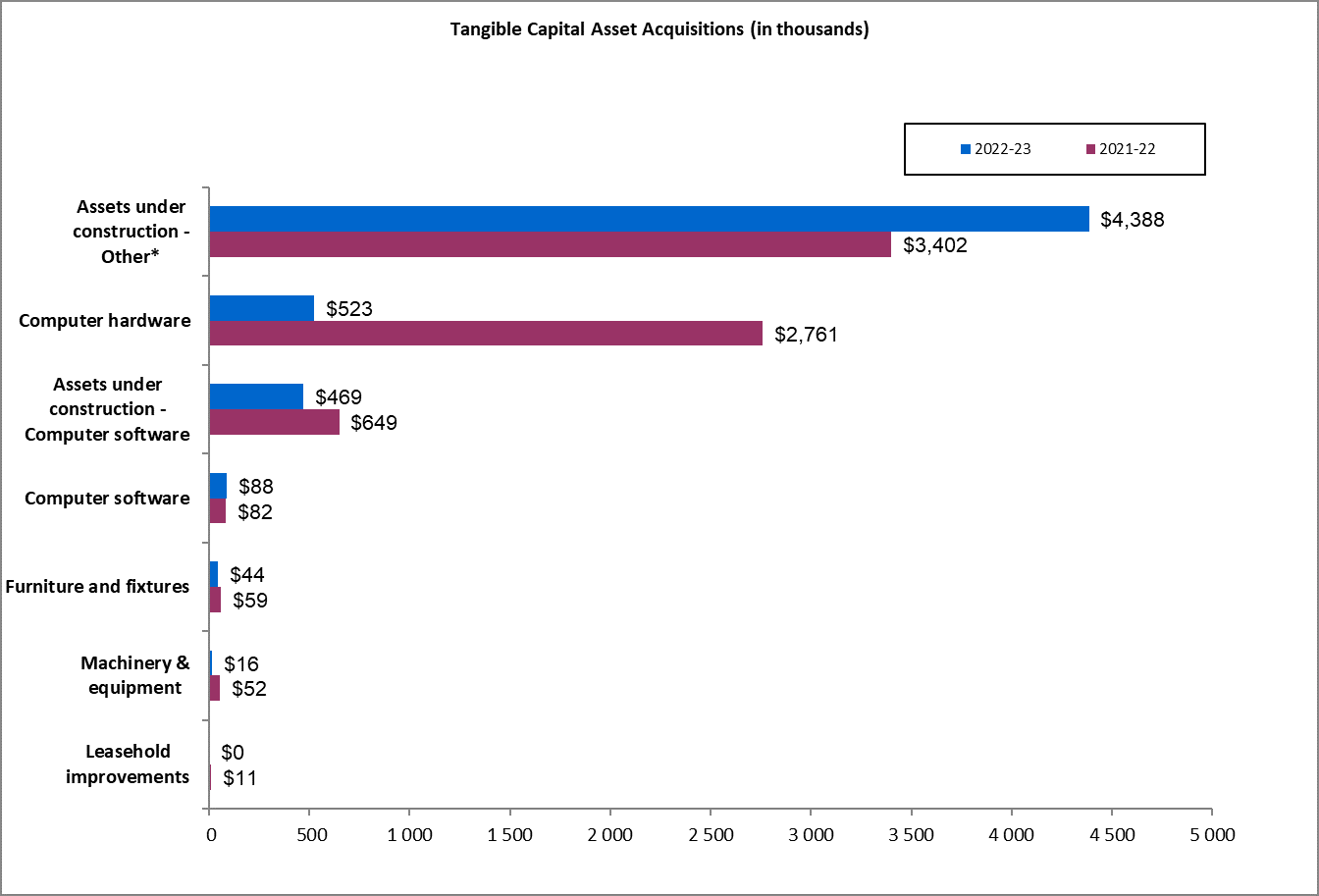

Total tangible capital asset acquisitions were $5,528 thousand. Assets under construction - other account for 79%, computer hardware and software for 11%, Assets under construction - computer software for 8%, fixtures account for 1% and other component of the acquisition for less than 1%.

Tangible capital assets: As of March 31, 2023, CAS’s net book value of tangible capital assets was $25,676 thousand ($27,406 thousand as of March 31, 2022). The variance of $1,730 thousand represents acquisitions of $5,528 thousand, offset by amortization of $5,959 thousand and other adjustments of $1,299 thousand.

CAS’s capital asset acquisitions of $5,528 thousand ($7,016 thousand in 2021-22) were largely driven by projects related to facilities renovation projects, informatics and e-courtroom purchases and installation of informatics equipment:

- Other work under construction ($4,388 thousand) are mainly related to facilities renovations and modernization of the courtrooms as well as the expansion project for Toronto;

- IT hardware upgrades ($523 thousand) are mainly related to IT equipment required to support remote work and virtual court proceedings. Mostly acquisitions of polycoms, servers, switches and laptops;

- Software upgrades and improvements ($88 thousand) as well as software assets under development ($469 thousand), include the purchase of software and costs related to projects to develop and enhance in-house applications (e.g. e-filing, court case management software);

- Purchases of furniture and fixtures ($44 thousand) are mainly furniture for the for National Capital Region and regional for courtrooms and office; and,

- Machinery and equipment purchases ($16 thousand) for containers bought and used for storage.

Description of the image

Tangible Capital Asset Acquisitions

In 2022-23: Assets under construction - Other acquisitions were $4,388 thousand. Computer hardware acquisitions were $523 thousand. Assets under construction - Computer software acquisitions were $469 thousand. Computer software acquisitions were $88 thousand. Furniture and fixture acquisitions were $44 thousand. Machinery & equipment acquisitions were $16 thousand. Leasehold improvements acquisitions were $0 thousand.

In 2021-22: Assets under construction - Other acquisitions were $3,402 thousand. Computer hardware acquisitions were $2,761 thousand. Assets under construction - Computer software acquisitions were $649 thousand. Computer software acquisitions were $82 thousand. Furniture and fixture acquisitions were $59 thousand. Machinery & equipment acquisitions were $52 thousand. Leasehold improvements acquisitions were $11 thousand.

* Note: The category “Assets under construction – Other” includes all assets under construction except for the Computer software. The majority of these represent leasehold improvements that are not yet completed and put into service.

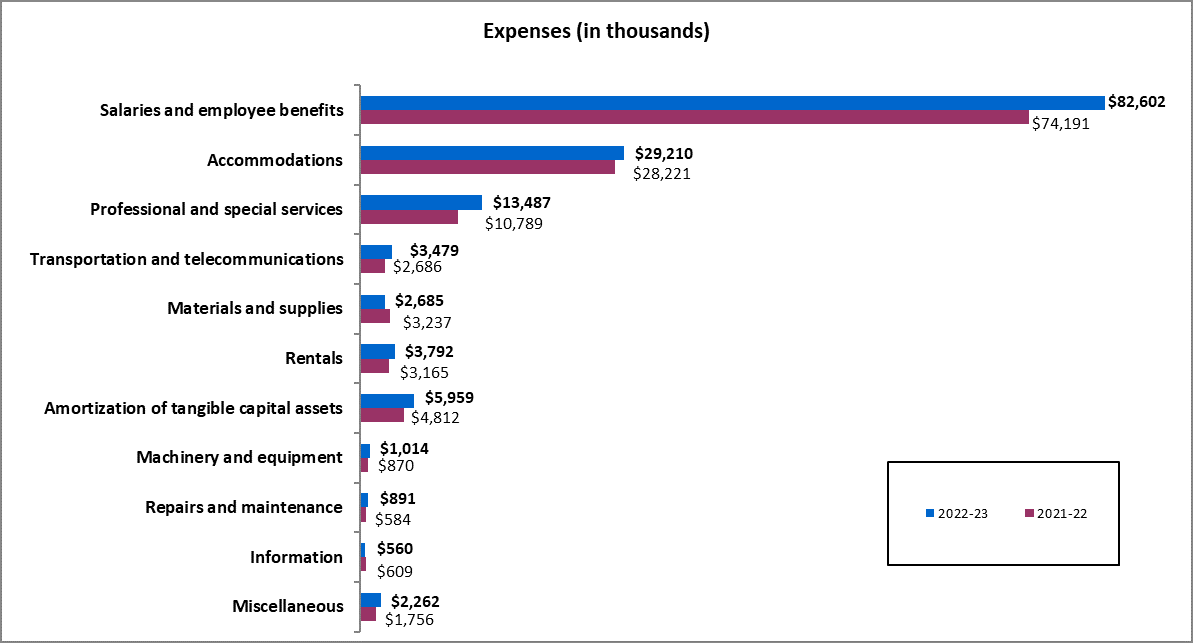

Expenses

CAS’s total expenses were $145,941 thousand in 2022-23 ($130,921 thousand in 2021-22). The increase of $15,020 thousand (11%) is comprised of increases of $8,411 thousand in salaries and employee benefits, $2,698 thousand in professional and special services, $1,147 thousand in amortization of tangible capital assets, $989 thousand in accommodations; $793 thousand in transportation and telecommunications, $627 thousand in rentals, $506 thousand in miscellaneous, $307 thousand in repairs and maintenance and $144 thousand in machinery and equipment. These increases were partly offset by decreases of $552 thousand in materials and supplies, $49 thousand in information and $1 thousand in expenses incurred on behalf the Government. The variances are explained below.

The largest categories of expenses are salaries and employee benefits (57% of total expenses in 2022-23, 57% in 2021-22), and accommodations (20% of total expenses in 2022-23, 22% in 2021-22). These two categories make up 77% of total expenses in the fiscal year 2022-23 and 79% in 2021-22.

Description of the image

Expenses

In 2022-23: Salary and employee benefits expense were $82,602 thousand. Accommodation expense were $29,210 thousand. Professional and special services expense were $13,487 thousand. Transportation and telecommunications expense were $3,479 thousand. Materials and supplies expense were $2,685 thousand. Rentals expense were $3,792 thousand. Amortization of tangible capital assets was $5,959 thousand. Machinery and equipment expense were $1,014 thousand. Repairs and maintenance expense were $891 thousand. Information expense were $560 thousand. Miscellaneous expense were $2,262 thousand.

In 2021-22: Salary and employee benefits expense were $74,191 thousand. Accommodation expense were $28,221 thousand. Professional and special services expense were $10,789 thousand. Transportation and telecommunications expense were $2,686 thousand. Materials and supplies expense were $3,237 thousand. Rentals expense were $3,165 thousand. Amortization of tangible capital assets was $4,812 thousand. Machinery and equipment expense were $870 thousand. Repairs and maintenance expense were $584 thousand. Information expense were $609 thousand. Miscellaneous expense were $1,756 thousand.

Salaries and employee benefits: Salaries and employee benefits expenses were $82,602 thousand in 2022-23 ($74,191 thousand in 2021-22). These costs represent gross salaries and wages, overtime pay, retroactive salary adjustments, employee entitlements and allowances, severance pay, and pension and medical benefits. The increase of $8,411 thousand (11%) variance is mainly due to an increase in regular salaries of $6,316 thousand due to higher salaries and new hires to fill newly created judicial positions.

The increase is also explained by an increase of $792 thousand in employer contributions to employee benefit plans, an increase of $477 thousand in allowance for compensatory and vacation pay, $370 in provision for severance benefits for all other departments, $376 thousand in various overtime premium pay, and $259 thousand in retroactive pay. This increase was offset by a decrease of $160 thousand in payments for Phoenix damages, a decrease of $66 thousand in other allowances and benefits paid, and various minor variances composing the remaining $38 thousand decrease.

Accommodations: Accommodation expense was $29,210 thousand in 2022-23 ($28,221 thousand in 2021-22). This amount represents the value of accommodation services, including rent, provided without charge by Public Services and Procurement Canada, a common service organization providing accommodation services to the Government.

Professional and special services: Professional and special services expenses were $13,487 thousand in 2022-23 ($10,789 thousand in 2021-22). These costs include translation services, protection services, IT services, court reporter and transcription services, deputy judges and training services. The increases in costs where driven by the expansion of judicial operations resulting in additional support requirements. The increase of $2,698 thousand (25%) is mainly due to an increase of $694 thousand in engineering and architectural services, $618 thousand in protection services, $540 thousand in IT services, $459 thousand in interpretation and translation services, $311 thousand in business services (court usher fees, court reporter fees, transcripts, etc.), $274 thousand in training and educational services, $19 thousand in special fees & services (memberships, hospitality), and $16 thousand in management consulting. This increase was partly offset by a decrease of $219 thousand in other services and $14 thousand in legal services.

Transportation and telecommunications: Transportation and telecommunications expenses were $3,479 thousand in 2022-23 ($2,686 thousand in 2021-22). The increase of $793 thousand (30%) is mainly driven by an increase of $711 thousand in travel, $106 thousand in postage and freight and $3 thousand in relocation. This increase is partly offset by a decrease of $27 thousand in telecommunication services.

Materials and supplies: Materials and supplies expenses were $2,685 thousand in 2022-23 ($3,237 thousand in 2021-22). These include legal books, publications and subscriptions (except electronic subscriptions), toner as well as stationery and supplies. The decrease of $552 thousand (-17%) is mainly due to a decrease of $843 thousand in chemical products (Plexiglas installed in 2021-22 and 2022-23 during the COVID & toner). This decrease was offset by an increase of $138 thousand in miscellaneous goods and products, $114 thousand in books, publications and subscriptions, $18 thousand in personal goods (robes, uniforms), $15 thousand in mineral products (gasoline), and $6 thousand in other smaller supplies.

Rentals: Rentals expenses were $3,792 thousand in 2022-23 ($3,165 thousand in 2021-22); The Rentals costs also include annual use of application software licenses. The increase of $627 thousand (20%) is primarily due to an increase of $331 thousand in IT licenses and maintenance fees, $289 thousand in the rental of office buildings and $13 thousand in other rentals. This increase is partly offset by a decrease of $6 thousand in the rental of machinery and equipment (photocopiers, etc.)

Amortization of tangible capital assets: Amortization expense was $5,959 thousand in 2022-23 ($4,812 thousand in 2021-22). Tangible capital assets are expected to yield benefits over several years. Consequently, their cost is amortized on a straight-line basis over the estimated useful life of each asset class. The increase of $1,147 thousand (24%) is due to an increase of $621 thousand related to IT hardware, $368 thousand related to leasehold improvements, $143 thousand related to IT software, $10 thousand related to machinery and equipment and $6 thousand for other equipment, including furniture. This increase is partly offset by a decrease of $1 thousand related to vehicles.

Machinery and equipment: Machinery and equipment expenses were $1,014 thousand in 2022-23 ($870 thousand in 2021-22). This includes purchases of assets with a cost less than $10 thousand, such as computer equipment, parts and software, office equipment, furniture, and motor vehicle parts. The increase of $144 thousand (17%) is mainly due to an increase of $199 thousand in computer equipment as a result of the prescribed on-site presence in the workplace. The increase was offset by a decrease of $47 thousand in small safety equipment, $8 thousand in office furniture.

Repairs and Maintenance: Repairs and maintenance expenses were $891 thousand in 2022-23 ($584 thousand in 2021-22). The increase of $307 thousand (53%) is mostly due to an increase of $300 thousand in repairs and maintenance of buildings.

Information: Information expense was $560 thousand in 2022-23 ($609 thousand in 2021-22). The decrease of $49 thousand (-8%) is due to a decrease of $92 thousand in printing services and $37 thousand in publishing services, which was partly offset by an increase of $55 thousand in communications professional services and $25 thousand in subscriptions.

Miscellaneous: Miscellaneous expense was $2,262 thousand in 2022-23 ($1,756 thousand in 2021-22). The increase of $506 thousand (29%) is mostly due to the $1,109 thousand increase in reclassification of capital assets under construction to expenses. This increase was partly offset by a decrease of $331 thousand in prepaid annual licenses fees to expenses; as well as a $271 thousand decrease in inventory consumption, mainly due to the usage of COVID personal protective supplies in 2021-22, which were no longer needed in 2022-23. The remaining variance is explained by a decrease of $1 thousand in other miscellaneous expenses.

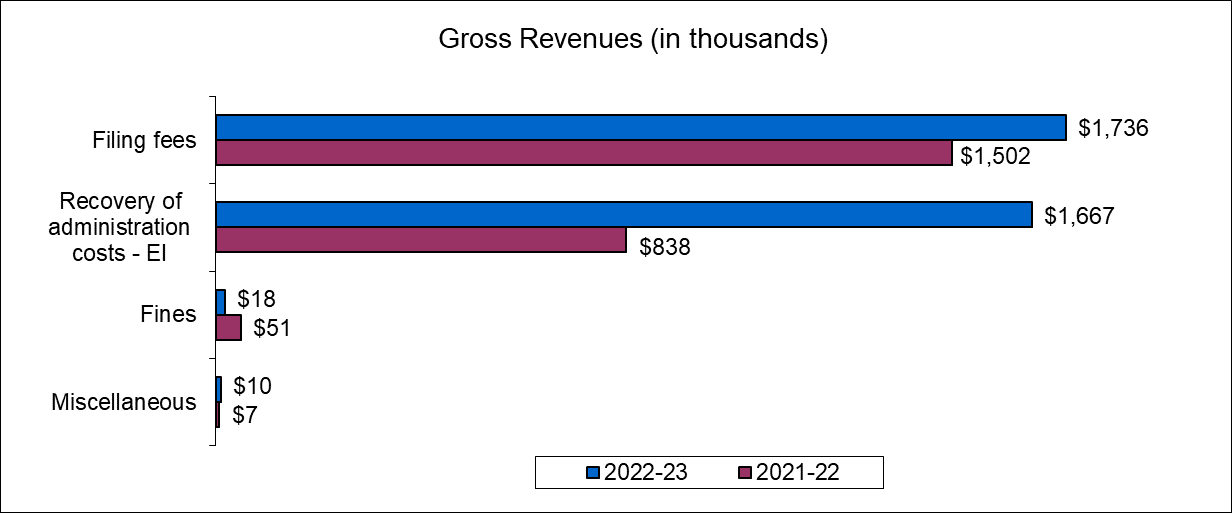

Revenues

CAS’s gross revenues were $3,431 thousand in 2022-23 ($2,398 thousand in 2021-22). CAS’s revenues may fluctuate widely from year-to-year and consist almost entirely of revenues earned on behalf of the Government. Such revenues are non-respendable by CAS and are deposited directly into the CRF. In 2022-23, these non-respendable revenues totalled $3,431 thousand ($2,398 thousand in 2021-22).

CAS’s net revenues were $0 thousand in 2022-23 ($0 thousand in 2021-22). This consists of revenues from the disposal of Crown assets, which are respendable.

CAS’s net revenues were $0 thousand in 2021-22 ($5 thousand in 2020-21). This consists of revenues from the disposal of Crown assets, which are respendable.

Description of the image

Gross Revenues

In 2022-23: Filing fees revenues were $1,736 thousand. Recovery of administration costs - EI was $1,667 thousand. Fines revenues were $18 thousand. Miscellaneous revenues were $10 thousand.

In 2021-22: Filing fees revenues were $1,502 thousand. Recovery of administration costs - EI was $838 thousand. Fines revenues were $51 thousand. Miscellaneous revenues were $7 thousand.

Filing fees: Filing fees revenue was $1,736 thousand in 2022-23 ($1,502 thousand in 2021-22). Filing fees are charged for registered court documents pursuant to the legislation and rules governing the Courts.

Recovery of administration costs – Employment Insurance: Recovery of administration costs for Employment Insurance (EI) was $1,667 thousand in 2022-23 ($838 thousand in 2021-22). At the end of each fiscal year, CAS determines the cost associated with the administration of EI cases for presentation by Employment and Social Development Canada (ESDC), the department responsible for the EI account. Accordingly, ESDC reports an expense in its financial statements, and CAS reports an equivalent revenue item. This accounting exercise is intended to reflect the total cost of running the federal government's EI program.

Fines: Fines revenue was $18 thousand in 2022-23 ($51 thousand in 2021-22). As noted previously, these fines are imposed by the Courts. Consequently, the total amount of fine revenues may vary significantly from year to year and cannot be predicted.

Miscellaneous: Miscellaneous revenue was $10 thousand in 2022-23 ($7 thousand in 2021-22). Miscellaneous revenue is mainly composed of photocopy revenues.

- Date modified: