Report on Plans and Priorities 2014-15

The Report on Plans and Priorities (RPP) is published in PDF and HTML formats.

The original version was signed by

Honourable Peter MacKay, P.C., M.P.

Minister of Justice and Attorney General of Canada

2014-15 Estimates

PART III - Departmental Expenditure Plans: Reports on Plans and Priorities

Purpose

Reports on Plans and Priorities (RPP) are individual expenditure plans for each department and agency. These reports provide increased levels of detail over a three-year period on an organization's main priorities by strategic outcome, program and planned/expected results, including links to related resource requirements presented in the Main Estimates. In conjunction with the Main Estimates, Reports on Plans and Priorities serve to inform members of Parliament on planned expenditures of departments and agencies, and support Parliament's consideration of supply bills. The RPPs are typically tabled soon after the Main Estimates by the President of the Treasury Board.

Estimates Documents

The Estimates are comprised of three parts:

Part I — Government Expenditure Plan — provides an overview of the Government's requirements and changes in estimated expenditures from previous fiscal years.

Part II — Main Estimates — supports the appropriation acts with detailed information on the estimated spending and authorities being sought by each federal organization requesting appropriations.

In accordance with Standing Orders of the House of Commons, Parts I and II must be tabled on or before March 1.

Part III — Departmental Expenditure Plans – consists of two components:

- Report on Plans and Priorities (RPP)

- Departmental Performance Report (DPR)

DPRs are individual department and agency accounts of results achieved against planned performance expectations as set out in respective RPPs.

The DPRs for the most recently completed fiscal year are tabled in the fall by the President of the Treasury Board.

Supplementary Estimates support Appropriation Acts presented later in the fiscal year. Supplementary Estimates present information on spending requirements that were either not sufficiently developed in time for inclusion in the Main Estimates or have subsequently been refined to account for developments in particular programs and services. Supplementary Estimates also provide information on changes to expenditure forecasts of major statutory items as well as on such items as: transfers of funds between votes; debt deletion; loan guarantees; and new or increased grants.

For more information on the Estimates, please consult the Treasury Board Secretariat website. Footnote i

Links to the Estimates

As shown above, RPPs make up part of the Part III of the Estimates documents. Whereas Part II emphasizes the financial aspect of the Estimates, Part III focuses on financial and non-financial performance information, both from a planning and priorities standpoint (RPP), and an achievements and results perspective (DPR).

The Management Resources and Results Structure (MRRS) establishes a structure for display of financial information in the Estimates and reporting to Parliament via RPPs and DPRs. When displaying planned spending, RPPs rely on the Estimates as a basic source of financial information.

Main Estimates expenditure figures are based on the Annual Reference Level Update which is prepared in the fall. In comparison, planned spending found in RPPs includes the Estimates as well as any other amounts that have been approved through a Treasury Board submission up to February 1st (see Definitions section). This readjusting of the financial figures allows for a more up to date portrait of planned spending by program.

Changes to the presentation of the Report on Plans and Priorities

Several changes have been made to the presentation of the RPP partially to respond to a number of requests - from the House of Commons Standing Committees on Public Accounts (PAC - Report 15 Footnote ii), in 2010; and on Government and Operations Estimates (OGGO - Report 7 Footnote iii ), in 2012 - to provide more detailed financial and non-financial performance information about programs within RPPs and DPRs, thus improving the ease of their study to support appropriations approval.

- In Section II, financial, human resources and performance information is now presented at the program and sub-program levels for more granularity.

- The report's general format and terminology have been reviewed for clarity and consistency purposes.

- Other efforts aimed at making the report more intuitive and focused on Estimates information were made to strengthen alignment with the Main Estimates.

How to read this document

RPPs are divided into four sections:

Section I: Organizational Expenditure Overview

This Organizational Expenditure Overview allows the reader to get a general glance at the organization. It provides a description of the organization's purpose, as well as basic financial and human resources information. This section opens with the new Organizational Profile, which displays general information about the department, including the names of the minister and the deputy head, the ministerial portfolio, the year the department was established, and the main legislative authorities. This subsection is followed by a new subsection entitled Organizational Context, which includes the Raison d'être, the Responsibilities, the Strategic Outcomes and Program Alignment Architecture, the Organizational Priorities and the Risk Analysis. This section ends with the Planned Expenditures, the Alignment to Government of Canada Outcomes, and the Estimates by Votes.

Section II: Analysis of Programs by Strategic Outcome

This Section provides detailed financial and non-financial performance information for strategic outcomes, programs and sub-programs. This section allows the reader to learn more about programs by reading their respective description and narrative entitled "Planning Highlights". This narrative speaks to key services or initiatives which support the plans and priorities presented in Section I; it also describes how performance information supports the department's strategic outcome or parent program.

Section III: Supplementary Information

This section provides supporting information related to departmental plans and priorities. In this section, the reader will find future-oriented statement of operations and a link to supplementary information tables regarding transfer payments, as well as information related to the greening government operations, internal audits and evaluations, horizontal initiatives, user fees, major crown and transformational projects, and up-front multi-year funding, where applicable to individual organizations.

Section IV: Organizational Contact Information

In this last section, the reader will have access to organizational contact information.

Definitions

- Appropriation

- Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- Budgetary Vs. Non-budgetary Expenditures

- Budgetary expenditures - operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to crown corporations.

- Non-budgetary expenditures - net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- Expected Result

- An outcome that a program is designed to achieve.

- Full-Time Equivalent (FTE)

- A measure of the extent to which an employee represents a full person-year charge against a departmental budget. FTEs are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

- Government of Canada Outcomes

- A set of high-level objectives defined for the government as a whole.

- Management Resources and Results Structure (MRRS)

- A common approach and structure to the collection, management and reporting of financial and non-financial performance information.

- An MRRS provides detailed information on all departmental programs (e.g.: program costs, program expected results and their associated targets, how they align to the government's priorities and intended outcomes, etc.) and establishes the same structure for both internal decision making and external accountability.

- Planned Spending

- For the purpose of the RPP, planned spending refers to those amounts for which a Treasury Board (TB) submission approval has been received by no later than February 1, 2014. This cut-off date differs from the Main Estimates process. Therefore, planned spending may include amounts incremental to planned expenditure levels presented in the 2014-15 Main Estimates.

- Program

- A group of related resource inputs and activities that are managed to meet specific needs and to achieve intended results, and that are treated as a budgetary unit.

- Program Alignment Architecture

- A structured inventory of a department's programs, where programs are arranged in a hierarchical manner to depict the logical relationship between each program and the Strategic Outcome(s) to which they contribute.

- Spending Areas

- Government of Canada categories of expenditures. There are four spending areas Footnote iv (social affairs, economic affairs, international affairs and government affairs) each comprised of three to five Government of Canada outcomes.

- Strategic Outcome

- A long-term and enduring benefit to Canadians that is linked to the department's mandate, vision, and core functions.

- Sunset Program

- A time-limited program that does not have on-going funding or policy authority. When the program is set to expire, a decision must be made as to whether to continue the program. (In the case of a renewal, the decision specifies the scope, funding level and duration).

- Whole-of-Government Framework

- A map of the financial and non-financial contributions of federal organizations receiving appropriations that aligns their Programs to a set of high level outcome areas defined for the government as a whole.

ISSN 1713-921X

Table of Contents

- Chief Administrator's Message

- Section I: Organizational Expenditure Overview

- Section II: Analysis of Programs by Strategic Outcome

- Section III: Supplementary Information

- Section IV: Organizational Contact Information

- Endnotes

Chief Administrator's Message

I am pleased to present the 2014-15 Report on Plans and Priorities for the Courts Administration Service (CAS).

This report outlines the organization's priorities in support of four separate and independent federal superior courts of record: the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada.

The 2014-15 fiscal year will be filled with many important challenges. We will deploy all necessary efforts to maintain services, in an environment where the workload and the number of self represented litigants continue to increase. We will pay particular attention to the enhancement of security measures essential to the exercise of judicial activities, as well as the implementation of an IT environment that is more responsive to the needs of the courts, their members, their clients and our employees. We will also focus on providing our employees with modern working tools and better training opportunities.

The needs are many and resources are limited. We will continue our efforts to reallocate internal resources and work with central agencies to define a new funding model for the organization, in order not to compromise access to justice, and as such safeguard judicial independence.

I invite you to read this report to learn more about CAS' plans and priorities for the 2014-15 fiscal year.

Daniel Gosselin, FCPA, FCA Chief Administrator

Section I: Organizational Expenditure Overview

Organizational Profile

Minister: Honourable Peter MacKay, P.C., M.P.

Deputy Head: Daniel Gosselin, Chief Administrator

Ministerial Portfolio: Minister of Justice and Attorney General of Canada

Year Established: 2003

Main Legislative Authorities: Courts Administration Service Act. Footnote v

Organizational Context

Raison d'être

The Courts Administration Service (CAS) was established in 2003 with the coming into force of the Courts Administration Service Act. The role of CAS is to provide effective and efficient judicial, registry and corporate services to four superior courts of record - the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. The Act enhances judicial independence by placing administrative services at arm's length from the Government of Canada and enhances accountability for the use of public money.

Responsibilities

CAS recognizes the independence of the courts in the conduct of their own affairs and aims to provide each court with quality and efficient administrative and registry services. Pursuant to section 2 of the Act, CAS is mandated to :

- Facilitate coordination and cooperation among the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court and the Tax Court of Canada for the purpose of ensuring the effective and efficient provision of administrative services;

- Enhance judicial independence by placing administrative services at arm's length from the Government of Canada and by affirming the roles of chief justices and judges in the management of the courts; and

- Enhance accountability for the use of public money in support of court administration while safeguarding the independence of the judiciary.

Judicial Independence

Judicial independence is a cornerstone of the Canadian judicial system. Under the Constitution, the judiciary is separate from and independent of the executive and legislative branches of the Government of Canada. Judicial independence is a guarantee that judges will make decisions free of influence and based solely on fact and law. It has three components: security of tenure, financial security and administrative independence.

Strategic Outcome and Program Alignment Architecture (PAA)

- 1. Strategic Outcome: The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada

- 1.1 Program: Judicial Services

- 1.2 Program: Registry Services

- Internal Services

Organizational Priorities

| Priority | Type | Strategic Outcome |

|---|---|---|

| Security - Strengthen security for members of the courts, their users and employees. | Previously committed to | The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. |

| Description | ||

Why is this a priority?

|

||

| Priority | Type | Strategic Outcome |

|---|---|---|

| IM/IT - Provide a robust, reliable and secure IM/IT infrastructure and modernize judicial support systems. | Previously committed to | The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. |

| Description | ||

Why is this a priority?

|

||

| Priority | Type | Strategic Outcome |

|---|---|---|

| Long Term Financial Viability - Ensure the long-term financial viability of the organization. | Previously committed to | The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. |

| Description | ||

Why is this a priority?

|

||

| Priority | Type | Strategic Outcome |

|---|---|---|

| Human Resources Management - Support the needs of employees. | Previously committed to | The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. |

| Description | ||

Why is this a priority?

|

||

Risk Analysis

CAS consistently applies a comprehensive approach to identify, assess and manage risks in its operating environment. On an annual basis, CAS updates its Corporate Risk Profile (CRP) to capture key risks that may affect its ability to achieve expected results and deliver on its mandate. Risk management principles are integrated into corporate decisions and plans, and the effectiveness of mitigation strategies are monitored on a quarterly basis. These steps are integral to the ongoing enhancements being made to further CAS' approach to sound enterprise risk management.

In 2013-14, CAS conducted an environmental scan to begin the process of updating its 2014-15 CRP. The aim of the scan was to collate information on changes in the organization's risk environment to determine whether CAS continues to respond appropriately to the risks identified in its 2013-14 CRP and to ascertain the level of consultation required in the development of the 2014-15 CRP.

Based on the results of the environmental scan and the risk consultation undertaken to develop the profile, the first risk, Access to Justice, remained at approximately the same level of severity as was indicated in the CRP 2013-14, and the ratings of two of the four risks — Courts and Registry Information Technology System and Security — were slightly increased. The increases were largely due to external challenges beyond CAS' control including the critical need for program integrity funding and various cost containment measures imposed on CAS. Effective implementation of mitigation activities reduced CAS' exposure to its Information Management risk and allowed the assignment, management and oversight of this risk at the branch level.

The table below outlines the risks identified in the 2014-15 CRP in order of risk exposure and levels, and the linkages between each risk and the organizational strategic priorities. In 2014-15, CAS will continue to do everything within its control to mitigate those risks. However, progress is contingent on CAS' ability to secure additional resources to fund planned security and IT initiatives in support of its risk response strategies.

| Risk | Risk Response Strategy | Link to Program Alignment Architecture |

|---|---|---|

| Access to Justice - There is a risk that the access to justice could be compromised by insufficient funding thereby challenging judicial independence. Link to Strategic Priority 3: Long Term Financial Viability |

|

Strategic Outcome - The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. Programs - Judicial Services and Registry Services |

| Courts and Registry Information Technology (IT) Systems - There is a risk that the courts and registry information technology systems and infrastructure will be unable to meet the requirements of evolving technology and growth in program activities. Link to Strategic Priority 2: IM/IT |

|

Strategic Outcome - The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. Programs - Judicial Services and Registry Services |

| Security - There is a risk that security may compromised. Link to Strategic Priority 1: Security |

|

Strategic Outcome - The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. Programs - Judicial Services and Registry Services |

The first risk relates to the potential challenges that CAS may confront in supporting "Access to Justice". This risk stems from a number of factors including the scope and complexity of federal courts system; the increasing demands on available resources; the potential impact of the increasing workload of the federal courts; the ongoing need to support Canada's evolving fiscal objectives, government-wide rules and legislative changes. In 2014-15, CAS' risk responses will include measures to address anticipated lapse in funding for key initiatives and to bolster internal program, policies, directives, standards and tools developed in support of the modernization of CAS security and information technology. Key mitigation measures will also include maintaining existing mechanisms in place to monitor the implementation of cost-savings measures. This includes early identification of any obstacles and ensuring ongoing dialogue with the Chief Justices and central agencies.

The second risk relates to the challenges with aligning the courts and registry information technology systems (including tools and processes) with CAS' operational requirements. This is necessary to ensure that CAS will be able to meet the needs of evolving technology, growth in program activities as well as current and future technology-enabled solutions. The risk is driven by factors such as, insufficient resources to finance important IT projects, the inability of current systems to meet the evolving needs of CAS programs, and increases in system integration requirements. In response to this risk, CAS will focus on striking an appropriate balance between the maintenance of existing legacy systems, investing in new systems and taking steps aimed at securing new funding. Mitigation strategies will also include the development of a CAS IT network performance roadmap which will address IT infrastructure gaps and offer an enterprise architecture approach and an action plan.

The third risk relates the challenges to fully meet the security requirements of the organization. This risk is driven partly by the lack of funding required to finance necessary security initiatives and the increase in the workload of the courts which is in part driven by the number of self-represented litigants and vexatious clients. CAS' response to this risk will include the implementation of programs to address the findings of the Threat and Risk Assessment completed in 2013, including clarification of issues of accountability/responsibility for court security and plans to address funding requirements in support of the development and implementation of court security programs. Mitigation strategies will also include the development of national court security standards and CAS' business continuity and disaster recovery plans.

Planned Expenditures

| 2014—15 Main Estimates |

2014—15 Planned Spending |

2015—16 Planned Spending |

2016—17 Planned Spending |

|---|---|---|---|

| 68,044,743 | 68,044,743 | 63,823,680 | 63,973,680 |

Note: The planned spending column reflects the amounts expected to be allocated to CAS in the Main Estimates for each fiscal year. In prior RPPs, planned spending amounts have included an estimate for paylist shortfall and related employee benefits plans. Paylist shortfall includes maternity and parental leave benefits, vacation credits payable upon termination of employment with the public service, and severance pay. Given the fluctuations in paylist shortfall amounts, they are completely excluded from planned spending. The financial resources for the implementation of Bill C-11, an Act to amend the Immigration and Refugee Protection Act (Balanced Refugee Reform Act) and the Federal Courts Act are included in the table above.

| 2014—15 | 2015—16 | 2016—17 |

|---|---|---|

| 628 | 606 | 606 |

Note: The human resources for the implementation of Bill C-11, an Act to amend the Immigration and Refugee Protection Act (Balanced Refugee Reform Act) and the Federal Courts Act are included in the table above. Also, 2014-15 represents the final year of funding related to Division 9 proceedings of the Immigration and Refugee Protection Act (IRPA) aimed at addressing challenges in the management of security inadmissibility cases, protecting classified information in immigration proceedings, and obtaining diplomatic assurances of safety for inadmissible individuals facing a risk of torture.

| Strategic Outcome, Programs and Internal Services | 2011—12 Expenditures |

2012—13 Expenditures |

2013—14 Forecast Spending |

2014—15 Main Estimates |

2014—15 Planned Spending |

2015—16 Planned Spending |

2016—17 Planned Spending |

|---|---|---|---|---|---|---|---|

| Strategic Outcome: The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. | |||||||

| Judicial Services | 21,576,245 | 21,125,246 | 21,677,866 | 22,379,302 | 22,379,302 | 21,445,479 | 21,445,479 |

| Registry Services | 29,146,563 | 25,400,192 | 25,873,777 | 26,673,348 | 26,673,348 | 25,143,766 | 25,143,766 |

| Strategic Outcome Subtotal | 50,722,808 | 45,525,438 | 47,551,643 | 49,052,650 | 49,052,650 | 46,589,245 | 46,589,245 |

| Internal Services Subtotal | 22,499,604 | 19,058,769 | 22,500,096 | 18,992,093 | 18,992,093 | 17,234,435 | 17,384,435 |

| Total | 73,222,412 | 65,584,207 | 70,051,739 | 68,044,743 | 68,044,743 | 63,823,680 | 63,973,680 |

Note: The increase shown in internal services in the 2013-14 spending forecast is due in part to the option offered to many employees through collective agreements to convert severance pay entitlements into cash. The employee groups who exercised this option in 2013-14 fall principally into the internal services category. The second item causing the increase in internal services in the 2013-14 spending forecast is related to the centralized nature of internal services at CAS. IT and security spending which support the organization's core programs are charged to internal services. Expenditures in 2011-12 and 2012-13 as well as the 2013-14 forecast include paylist shortfall amounts. Paylist shortfall includes maternity and parental leave benefits, vacation credits payable upon termination of employment with the public service, and severance pay. Given the fluctuations in paylist shortfall amounts, they are excluded from planned spending.

Alignment to Government of Canada Outcomes

| Strategic Outcome | Program | Spending Area | Government of Canada Outcome | 2014-15 Planned Spending |

|---|---|---|---|---|

| The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. | Judicial Services | Government Affairs | Strong and independent democratic institutions | 22,379,302 |

| Registry Services | Government Affairs | Strong and independent democratic institutions | 26,673,348 |

| Spending Area | Total Planned Spending |

|---|---|

| Economic Affairs | N/A |

| Social Affairs | N/A |

| International Affairs | N/A |

| Government Affairs | 49,052,650 |

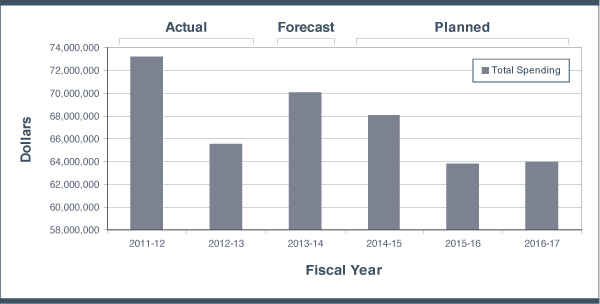

Departmental Spending Trend

Departmental Spending Trend Graph

Description of the image

Departmental Spending Trend

This graph represents the spending trend: the Actual, Forecast and Planned Spending, from 2011-12 to 2016-17.

- In 2011-12, actual spending was $73.2 M.

- In 2012-13, actual spending was $65.6 M.

- In 2013-14, forecasted spending was $70.0 M.

- In 2014-15, planned spending will be $68.0 M.

- In 2015-16, planned spending will be $63.8 M.

- In 2016-17, planned spending will be $63.9 M.

Actual, Forecast and Planned Spending 2011-12 to 2016-17

Note: The above graph includes amounts related to paylist expenditures in the actual and forecast amounts only. Given the fluctuations in paylist shortfall amounts, they are excluded from planned spending

The variations in spending seen in the chart are attributable to a series of factors which fall under two broad categories: CAS' responsibilities and cost containment measures.

In the first category, the significant level of actual spending in 2011-12 includes: payments to employees in relation to collective agreements signed in 2011; a major investment in information technology infrastructure to address rust-out issues, including the construction of a new data centre; and the provision in Budget 2011 for permanent program integrity funding for CAS to address some of its security concerns and to fund legislatively mandated judicial appointments.

In the second category, the factors related to government decisions include lump sum funding for collective agreements and existing employee benefits such as severance and maternity pay. One such example is the option offered to many employees to convert severance pay entitlements into cash; this represents the biggest single component in the 2011-12 increase in spending. Other factors affecting spending from year-to-year include various cost containment measures imposed on CAS.

There is an increase in forecasted spending in 2013-14 mainly due to the completion of severance liquidation payments, a carryforward for the completion of projects, salary increases as a result of collective agreements, and one judicial appointment made in 2013-14 for refugee reform under Bill C-11 for which expenditures are being incurred. Planned spending decreases in 2015-16 are related to the expiration of funding related to Division 9 proceedings of the Immigration and Refugee Protection Act (IRPA) aimed at addressing challenges in the management of security inadmissibility cases, protection of classified information in immigration proceedings, and obtaining diplomatic assurances of safety for inadmissible individuals facing a risk of torture. Furthermore, funding for support of additional judicial appointments for refugee reform under Bill C-11 is included in the planned spending levels but is not available to CAS until these appointments are made.

Estimates by Vote

For information on the Courts Administration Service's organizational appropriations, please see the 2014—15 Main Estimates publication. Footnote vii

Contribution to the Federal Sustainable Development Strategy (FSDS)

Courts Administration Service also ensures that its decision-making process includes a consideration of the FSDS goals and targets through the strategic environmental assessment (SEA). An SEA for policy, plan or program proposals includes an analysis of the impacts of the proposal on the environment, including on the FSDS goals and targets. The results of SEAs are made public when an initiative is announced or approved, demonstrating that environmental factors were integrated into the decision-making process.

Section II: Analysis of Programs by Strategic Outcome

Strategic Outcome: The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada.

Program 1.1: Judicial Services

Description:The Judicial Services program provides legal services and judicial administrative support to assist members of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada in the discharge of their judicial functions. These services are provided by legal counsels, judicial administrators, law clerks, jurilinguists, judicial assistants, library personnel and court attendants, under the direction of the four Chief Justices.

| 2014-15 Main Estimates |

2014-15 Planned Spending |

2015-16 Planned Spending |

2016-17 Planned Spending |

|---|---|---|---|

| 22,379,302 | 22,379,302 | 21,445,479 | 21,445,479 |

| 2014—15 | 2015—16 | 2016—17 |

|---|---|---|

| 190 | 186 | 186 |

| Expected Results | Performance Indicators | Targets | Date to be Achieved |

|---|---|---|---|

| Members of the courts have the legal services and administrative support they require to discharge their judicial functions. | % of final court decisions posted on the courts websites within established timeframes | 95% | March 31, 2015 |

Planning Highlights

CAS will provide key strategic management and legal advice to the four Chief Justices and other members of the courts. The services include support and legal advice to a number of court committees that facilitate dialogue among the courts, litigants and the public. These committees provide a forum for discussions on court practices and proposed amendments to court rules. Judicial Services will support an initiative to modernize the Federal Courts Rules and remove obstacles to the use of technology in court processes. Assistance will also be given to the members of the Tax Court of Canada Rules Committee on proposed amendments to the Tax Court of Canada Rules and subsequent implementation of the changes that are consequential to the amendments made to the Tax Court of Canada Act in June 2013.

The registries of the Federal Court of Appeal, the Federal Court and the Tax Court of Canada provide services to an increasing number of self-represented litigants that require assistance from Judicial Services regarding rules, procedures and documentation. Further, legal costs, time required for resolving disputes and other barriers to accessing the courts have also increased. To address this challenge, CAS will work with the courts to make more user-friendly information available on the courts' websites, and aim at developing self-service tools and options to assist self-represented litigants in becoming more self-reliant. CAS will also support the Federal Court of Appeal and the Federal Court with the review of the Federal Courts Rules to identify where simplification or clarification may be warranted. These initiatives will promote better access to justice and greater awareness of the courts.

To improve the efficiency and accessibility of court records and reduce ongoing storage and management cost, CAS will complete the implementation of the court records retention and digitization project. It will also collaborate on the Federal Court's pilot project, to develop an e-Court solution for lengthy trials involving a number of parties and thousands of documents. This project should yield resource savings for the Court and the parties as electronic access and quick e-search capability are expected to reduce the estimated document retrieval time.

Program 1.2: Registry Services

Description

Registry Services are delivered under the jurisdiction of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. The registries process legal documents, provide information to litigants on court procedures, maintain court records, participate in court hearings, support and assist in the enforcement of court orders, and work closely with the Offices of the four Chief Justices to ensure that matters are heard and decisions are rendered in a timely manner. Registry Services are offered in every province and territory through a network of permanent offices and agreements with provincial and territorial partners.

Budgetary Financial Resources (dollars)

| 2014-15 Main Estimates |

2014-15 Planned Spending |

2015-16 Planned Spending |

2016-17 Planned Spending |

|---|---|---|---|

| 26,673,348 | 26,673,348 | 25,143,766 | 25,143,766 |

| 2014-15 | 2015-16 | 2016-17 |

|---|---|---|

| 292 | 281 | 281 |

| Expected Results | Performance Indicators |

Targets | Date to be Achieved |

|---|---|---|---|

| Public has access to information regarding Courts' processes across Canada. | % of reviewed court documents that are processed accurately | 95% | March 31, 2015 |

Planning Highlights

Registry services are critical for the efficient and effective delivery of justice by the courts. During the upcoming year, CAS will continue to allocate and reallocate its resources to meet the changing workload requirements and the essential needs of each court. The high variability in the number and duration of proceedings and hearings has a significant impact on the costs of court reporters, transcripts, simultaneous interpretation, videoconferencing, travel, contracted court registrars, ushers and translation. For example, the Tax Court of Canada has experienced consistent increases in caseload. The number of appeals and applications filed in the last two years exceeded the average of the last three years by 23%. Such increases directly impact registry operations and hearings and pose a significant financial risk for CAS. In addition because of these increases, non-discretionary expenses are extremely difficult to manage within CAS' fixed reference levels. To address this concern, CAS will continue to monitor the number of proceedings and hearings as well as legislative and policy developments which may impact workloads and reallocate resources as required.

CAS will also continue to support a number of key initiatives to ensure the delivery of quality registry services to the courts. This includes the maintenance, development and implementation of the courts and registry technology systems which support the judicial process and are essential to the delivery of registry services. However, the current systems used by the courts are obsolete, inefficient and cannot integrate new functionalities such as e-filing and the automatic posting of decisions on court websites. Before significant progress can be made, CAS must identify funding for these important initiatives. In the interim, CAS must invest in the maintenance of its legacy systems to ensure the ongoing delivery of registry services.

Finally, CAS will also assist the courts in keeping current and improving their processes, procedures and directives to enhance client service nationwide. These updates will ensure the alignment of procedures and directives with changes introduced by new technology such as the Digital Audio Recording System and will be supported by operational training.

Internal Services

Description:

Internal Services are groups of related activities and resources that are administered to support the needs of programs and other corporate obligations of an organization. These groups are: Management and Oversight Services; Communications Services; Legal Services; Human Resources Management Services; Financial Management Services; Information Management Services; Information Technology Services; Real Property Services; Materiel Services; Acquisition Services; and Other Administrative Services. Internal Services include only those activities and resources that apply across an organization and not to those provided specifically to a program.

Budgetary Financial Resources (dollars)

| 2014-15 Main Estimates |

2014-15 Planned Spending |

2015-16 Planned Spending |

2016-17 Planned Spending |

|---|---|---|---|

| 18,992,093 | 19,992,093 | 17,234,435 | 17,384,435 |

| 2014—15 | 2015—16 | 2016—17 |

|---|---|---|

| 146 | 139 | 139 |

Planning Highlights

Providing adequate security for members of the courts, their users and employees will remain a top priority for CAS. Emphasis will be placed on addressing the findings of the Security Threat and Risk Assessment completed in the previous fiscal year. In addition, the courts and registry technology systems that support the judicial process are highly dependent on the IT infrastructure that supports them. As such, CAS will continue to upgrade its network architecture and technologies to improve the system and applications usability, reliability and security. Enhancements will also be made to improve mobile and remote connections across Canada, as well as the functionality and performance of critical software. This will ensure that members of the courts and employees are provided with current versions of software and will facilitate technology integration. The development and implementation a new Court and Registry Management System also remains a priority for CAS. However, several significant financial and operational challenges must still be overcome before these projects can proceed.

During the period covered by this report, CAS will also focus on enhancing communications between management and employees, strengthening its workforce by offering development opportunities, implementing a new performance management program, developing general competencies and introducing a more coordinated approach to training. These initiatives will lead to better support for employees and help maximize their contribution and engagement.

To advance on these initiatives, CAS must continue to manage and monitor closely its significant financial risk and work with central agencies to identify and secure appropriate funding. In addition, given CAS' program integrity issues, no contingency resources are available to deal with the financial risk associated with an increase in the volume or complexity of hearings or an increase in overall court workload. As these expenditures are beyond the control of CAS and possibilities for reallocation have been exhausted, any major unanticipated requirements will compel CAS to seek additional funding over and above the requirements for security and IT.

Section III: Supplementary Information

Future-Oriented Statement of Operations

The future-oriented condensed statement of operations presented in this subsection is intended to serve as a general overview of the Courts Administration Service's operations. The forecasted financial information on expenses and revenues are prepared on an accrual accounting basis to strengthen accountability and to improve transparency and financial management.

Because the future-oriented statement of operations is prepared on an accrual accounting basis and the forecast and planned spending amounts presented in other sections of this report are prepared on an expenditure basis, amounts will differ.

A more detailed future-oriented statement of operations and associated notes Footnote viii, including a reconciliation of the net costs of operations to the requested authorities, can be found on the Courts Administration Service's website.

| Financial information | Estimated Results 2013—14 |

Planned Results 2014—15 |

Change |

|---|---|---|---|

| Total expenses | 98,982,225 | 97,694,644 | (1,287,581) |

| Total revenues | 2,774 | 2,774 | 0 |

| Net cost of operations | 98,979,451 | 97,691,870 | (1,287,581) |

Estimated and planned results were determined based on an analysis of actual expenditures, results of internal forecasting exercises and prior year trends, and the use of professional judgment. With all assumptions, there is a measure of uncertainty surrounding them. This uncertainty increases as the forecast horizon extends.

The Courts Administration Service's total expenses are estimated to decrease from $98,982,225 in 2013-14 to $97,694,644 in 2014-15, a variance of $1,287,581 (-1.3%). The two major categories of expenses are salary and employee benefit and operating expenses.

- Salary and employee benefit expenses: Salary and employee benefit expenses are estimated to decrease slightly from $54,735,755 in 2013-14 to $54,673,189 in 2014-15, a variance of $62,566 (-0.1%). Over half of the Courts Administration Service's total expenses consist of salaries and employee benefits (55% of total expenses in 2013-14 and 56% of total expenses in 2014-15).

- Operating expenses: Operating expenses are estimated to decrease from $44,246,470 in 2013-14 to $43,021,455, a variance of $1,225,015 (-2.8%). This variance is attributable to decreases of $824,363 in machinery and equipment and $783,637 in accommodations, offset by other minor variances totalling $382,985.

The Courts Administration Service's total revenues are estimated to be $2,774 in both 2013-14 and 2014-15. The majority of the Courts Administration Service's revenues are earned on behalf of Government (i.e., non-respendable revenues). The total revenues figure presented in the above table is net of these non-respendable revenues. Further details on the Courts Administration Service's non-respendable revenues can be found in the detailed future-oriented statement of operations and associated notes.

List of Supplementary Information Tables

The supplementary information tables Footnote ix listed in the 2014-15 Report on Plans and Priorities can be found on the Courts Administration Service's website.

Section IV: Organizational Contact Information

Additional Information

Further information on the strategic planning portion of this document can be obtained by contacting:

Director, Corporate Secretariat

Courts Administration Service

Ottawa, Ontario

K1A 0H9

Info@cas-satj.gc.ca

Further information on the financial portion of this document can be obtained by contacting:

Director General, Finance and Contracting Services

Courts Administration Service

Ottawa, Ontario

K1A 0H9

Info@cas-satj.gc.ca

- Date modified: